Page 120 - SFG_ANNUALREPORT_12OCT_SINGLEPAGE

P. 120

NOTES TO THE FINANCIAL STATEMENTS (CONT.)

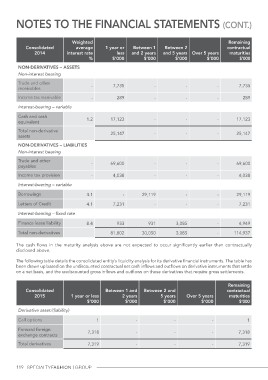

Consolidated Weighted 1 year or Between 1 Between 2 Remaining

2014 average less and 2 years contractual

and 5 years Over 5 years

interest rate $’000 $’000 maturities

% $’000 $’000 $’000

Non-derivatives – ASSETS

Non-interest bearing

Trade and other - 7,735 - - - 7,735

receivables 289 - - - 289

Income tax receivable - 17,123 - - - 17,123

25,147 - - - 25,147

Interest-bearing – variable

Cash and cash 1.2

equivalent

Total non-derivative

assets

NON-DERIVATIVES – LIABILITIES

Non-interest bearing

Trade and other - 69,600 - - - 69,600

payables - 4,038 - - - 4,038

Income tax provision - 29,119 - - 29,119

7,231 - - - 7,231

Interest-bearing – variable

933 931 3,085 - 4,949

Borrowings 4.1 81,802 30,050 3,085 - 114,937

Letters of Credit 4.1

Interest-bearing – fixed rate

Finance lease liability 8.4

Total non-derivatives

The cash flows in the maturity analysis above are not expected to occur significantly earlier than contractually

disclosed above.

The following table details the consolidated entity’s liquidity analysis for its derivative financial instruments. The table has

been drawn up based on the undiscounted contractual net cash inflows and outflows on derivative instruments that settle

on a net basis, and the undiscounted gross inflows and outflows on those derivatives that require gross settlements.

Consolidated 1 year or less Between 1 and Between 2 and Over 5 years Remaining

2015 $’000 2 years 5 years $’000 contractual

$’000 $’000

Derivative asset/(liability) - maturities

- - - $’000

Call options 1 -

- - 1

Forward foreign 7,318

exchange contracts - - 7,318

Total derivatives 7,319 7,319

119