Page 64 - SFG_ANNUALREPORT_12OCT_SINGLEPAGE

P. 64

REMUNERATION REPORT (CONT.)

All non-executive directors stand for re-election every 3 years and have no notice period, no annual remuneration

review, no eligibility for short term incentives, no eligibility for long term incentives, no severance period, no termination

benefits and no other benefits.

Key management personnel have no entitlement to termination payments in the event of removal for misconduct.

4. Share-based compensation

Issue of shares

There were no shares issued to directors and other key management personnel as part of compensation during the

year ended 30 June 2015.

Performance rights

The terms and conditions of each grant of performance rights over ordinary shares affecting remuneration of the Chief

Executive Officer and other key management personnel in this financial year or future reporting years are as follows:

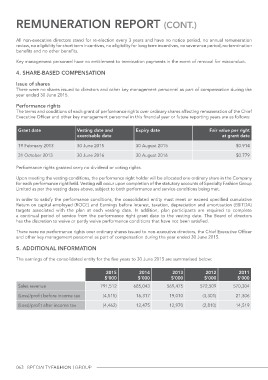

Grant date Vesting date and Expiry date Fair value per right

exercisable date at grant date

19 February 2013 30 August 2015

31 October 2013 30 June 2015 30 August 2016 $0.914

30 June 2016 $0.779

Performance rights granted carry no dividend or voting rights.

Upon meeting the vesting conditions, the performance right holder will be allocated one ordinary share in the Company

for each performance right held. Vesting will occur upon completion of the statutory accounts of Specialty Fashion Group

Limited as per the vesting dates above, subject to both performance and service conditions being met.

In order to satisfy the performance conditions, the consolidated entity must meet or exceed specified cumulative

Return on capital employed (ROCE) and Earnings before interest, taxation, depreciation and amortisation (EBITDA)

targets associated with the plan at each vesting date. In addition, plan participants are required to complete

a continual period of service from the performance right grant date to the vesting date. The Board of directors

has the discretion to waive or partly waive performance conditions that have not been satisfied.

There were no performance rights over ordinary shares issued to non-executive directors, the Chief Executive Officer

and other key management personnel as part of compensation during the year ended 30 June 2015.

5. Additional information

The earnings of the consolidated entity for the five years to 30 June 2015 are summarised below:

Sales revenue 2015 2014 2013 2012 2011

(Loss)/profit before income tax $’000 $’000 $’000 $’000 $’000

(Loss)/profit after income tax 791,512 685,043 569,475 572,509 570,304

(4,515) 16,317 19,010 (3,301) 21,306

(4,462) 12,475 12,970 (2,810) 14,519

063