Page 26 - PowerPoint

P. 26

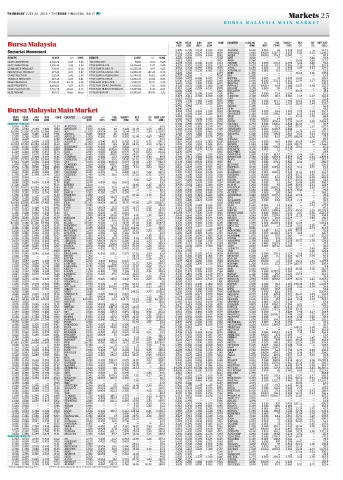

Markets 25

THURSDAY JULY 26, 2018 • THEEDGE FINANCIAL DAILY

BUR SA MAL A Y SIA MAIN MARKET

Bursa Malaysia YEAR YEAR HIGH LOW CODE COUNTER CLOSING (RM) (‘000) VWAP* PE# DY MKT CAP

VOL

DAY

+/–

DAY

(MIL)

HIGH

LOW

(RM)

(%)

(RM)

(X)

—

117.1

0.005

36

Sectorial Movement 0.835 0.405 0.540 0.535 4758 ANCOM 0.535 UNCH 1367.7 0.540 8.67 9.31 1,140.1

2.070

6556

2.010

1.630

3.814

5.42

2.040

ANNJOO

2.039

0.125 0.045 0.055 0.050 9342 ANZO 0.055 UNCH 776.2 0.053 — — 48.4

INDICES CLOSE +/- %CHG INDICES CLOSE +/- %CHG 1.120 0.800 — — 5568 APB 0.820 — — — — 3.66 92.6

—

—

—

—

—

KLSE COMPOSITE 1,763.78 0.85 0.05 TECHNOLOGY 38.82 -0.01 -0.03 3.812 3.208 0.760 0.730 5015 APM 3.560 0.030 278.7 0.750 15.56 3.65 717.7

ARANK

0.760

6.66

4.28

1.156

0.700

91.2

7214

KLSE INDUSTRIAL 3,238.23 1.34 0.04 FTSE BURSA 100 12,316.62 5.39 0.04 1.278 0.755 0.830 0.820 7162 ASTINO 0.820 -0.015 97.9 0.826 7.11 1.22 224.8

15

CONSUMER PRODUCT 738.84 -2.07 -0.28 FTSE BURSA MID 70 15,532.34 4.93 0.03 1.064 0.649 0.855 0.850 7099 ATTA 0.850 -0.020 8.9 0.850 3.25 9.41 177.1

12.5

0.223

—

0.320

0.205

0.230

0.100

0.205

0.005

—

7181

ATURMJU

INDUSTRIAL PRODUCT 173.20 0.29 0.17 FTSE BURSA SMALL CAP 14,984.35 107.24 0.72 2.226 1.260 — — 8133 BHIC 1.390 — — — 28.08 3.60 345.4

CONSTRUCTION 228.84 2.46 1.09 FTSE BURSA FLEDGLING 16,549.25 76.81 0.47 0.525 0.260 — — 7005 BIG 0.280 — — — — — 13.5

TRADE & SERVICES 219.12 0.23 0.11 FTSE BURSA EMAS 12,544.27 10.44 0.08 0.580 0.395 0.460 0.455 7187 BKOON 0.460 0.005 74 0.459 14.42 — 136.7

KLSE FINANCIAL 17,398.49 49.74 0.29 FTSE BUR M’SIA ACE 5,522.35 39.97 0.73 0.930 0.635 0.695 0.680 0168 BOILERM 0.690 -0.010 391.3 0.681 17.34 2.17 356.0

—

1.690

0.070

1.150

—

BOXPAK

1.000

6297

1.120

1.152

11

1.200

138.1

KLSE PROPERTY 1,086.82 -3.87 -0.35 FTSE BUR EMAS SHARIAH 12,680.02 7.81 0.06 1.348 0.833 1.000 1.000 5100 BPPLAS 1.000 UNCH 36.9 1.000 13.57 4.00 187.7

—

KLSE PLANTATION 7,541.96 -26.62 -0.35 FTSE BUR HIJRAH SHARIAH 14,099.56 -5.46 -0.04 0.310 0.160 0.205 0.195 9938 BRIGHT 0.195 -0.025 95 0.199 89.42 — 40.0

—

0.420

BSLCORP

—

0.800

—

—

—

0.465

—

45.6

7221

KLSE MINING 883.52 Unch Unch FTSE/ASEAN 40 10,832.60 140.55 1.31 0.320 0.140 0.150 0.140 7188 BTM 0.150 0.010 75.9 0.150 — — 21.2

3.373 2.311 2.400 2.380 5105 CANONE 2.400 UNCH 86.4 2.387 7.69 1.67 461.2

0.015 0.010 — — 5229 CAP 0.010 — — — — — 13.6

1.984 1.240 1.260 1.240 7076 CBIP 1.250 0.010 171.1 1.254 14.69 4.00 672.8

2.410 1.571 1.930 1.910 2879 CCM 1.930 0.010 12.6 1.928 28.98 5.44 323.7

1.750 1.350 — — 8435 CEPCO 1.370 — — — — — 61.3

Bursa Malaysia Main Market 1.240 1.040 1.560 1.530 8044 CFM 1.060 0.040 34.6 1.543 9.90 4.62 467.3

—

43.5

—

—

—

—

—

—

1.850

5007

1.560

CHINWEL

1.490

2.619 1.899 2.280 2.240 5797 CHOOBEE 2.280 0.030 205.8 2.263 6.13 2.63 250.6

—

—

—

—

—

YEAR YEAR DAY DAY CODE COUNTER CLOSING +/– VOL VWAP* PE# DY MKT CAP 1.450 0.850 0.040 0.040 8052 CICB 1.300 UNCH 19 0.040 23.13 1.35 65.0

0.040

CME

23.4

—

7018

—

0.035

0.060

HIGH LOW HIGH LOW (RM) (RM) (‘000) (RM) (X) (%) (MIL) 4.334 1.740 3.320 3.150 2852 CMSB 3.200 0.050 3000.4 3.218 14.97 2.50 3,438.0

CONSUMER PRODUCTS 0.900 0.330 0.900 0.770 7986 CNASIA 0.770 0.010 1140.1 0.818 21.63 — 34.9

0.565 0.345 — — 7120 ACOSTEC 0.380 — — — — — 67.6 1.490 0.940 1.210 1.190 5071 COASTAL 1.200 UNCH 55.1 1.200 89.55 1.67 637.9

7.150 4.580 7.150 7.080 7090 AHEALTH 7.100 0.020 87 7.102 17.49 1.69 831.7 0.386 0.160 0.205 0.185 7195 COMCORP 0.205 0.020 1659.7 0.200 — — 28.7

25.500 18.000 21.620 21.500 2658 AJI 21.620 UNCH 14 21.54 23.37 1.94 1,314.5 1.220 0.690 0.880 0.865 2127 COMFORT 0.875 0.010 1883.1 0.873 14.78 1.14 491.7

0.390 0.210 0.245 0.245 7051 AMTEK 0.245 UNCH 10 0.245 — — 12.2 1.783 1.270 1.400 1.370 5094 CSCSTEL 1.400 0.030 389.9 1.392 9.60 7.14 532.0

5.135 3.760 4.310 4.300 6432 APOLLO 4.300 -0.100 9.4 4.301 31.09 4.65 344.0 0.675 0.522 0.575 0.570 7157 CYL 0.575 0.015 16.9 0.572 638.89 6.96 57.5

1.040 0.690 — — 7722 ASIABRN 0.800 — — — — — 93.1 0.360 0.295 — — 5082 CYMAO 0.345 — — — — — 25.9

3.156 2.502 2.800 2.750 7129 ASIAFLE 2.800 0.040 50.3 2.782 9.22 5.71 545.3 2.387 2.000 2.010 2.000 8125 DAIBOCI 2.010 -0.030 45.5 2.004 24.69 2.24 659.1

43.052 22.224 34.380 34.020 4162 BAT 34.200 0.100 193 34.28 22.55 4.50 9,765.1 2.000 1.200 1.550 1.540 8176 DENKO 1.540 0.010 93 1.545 248.39 — 1,766.4

0.085 0.040 0.045 0.040 7243 BIOOSMO 0.040 -0.005 130 0.044 — — 31.8 0.460 0.270 0.330 0.325 7114 DNONCE 0.325 -0.005 928.4 0.326 19.01 — 63.0

0.670 0.400 0.465 0.450 9288 BONIA 0.455 0.010 1935.6 0.455 17.37 2.75 366.9 0.300 0.150 0.170 0.170 5835 DOLMITE 0.170 0.005 11 0.170 — — 48.4

1.103 0.810 0.980 0.955 7174 CAB 0.965 0.015 2500 0.970 9.02 0.52 621.4 0.270 0.090 — — 5265 DOLPHIN 0.110 — — — — — 26.9

1.170 0.292 0.970 0.940 7154 CAELY 0.965 0.010 472.8 0.956 53.61 1.04 77.2 1.379 1.166 1.290 1.260 7169 DOMINAN 1.280 -0.010 117.7 1.271 7.66 5.47 211.5

0.415 0.270 0.300 0.295 7128 CAMRES 0.300 0.010 14.7 0.298 9.29 3.33 59.0 2.750 1.511 2.280 2.240 1619 DRBHCOM 2.250 -0.010 3692.3 2.259 8.73 0.44 4,349.8

20.571 13.753 19.180 18.900 2836 CARLSBG 19.000 -0.320 99.5 19.00 24.76 4.53 5,809.2 1.478 0.908 1.240 1.180 7233 DUFU 1.220 -0.010 995.6 1.215 7.99 5.33 214.1

1.010 0.825 0.890 0.860 7035 CCK 0.870 -0.010 1179.6 0.877 15.08 1.72 548.7 0.775 0.465 0.575 0.550 8907 EG 0.565 0.010 875.1 0.564 6.96 — 150.7

1.490 0.814 1.280 1.250 7148 CCMDBIO 1.260 -0.020 439.7 1.260 18.83 2.89 834.0 0.890 0.634 0.795 0.785 9016 EKSONS 0.795 0.015 20 0.789 — 6.29 130.5

2.356 1.780 2.000 1.980 2828 CIHLDG 1.980 UNCH 27.5 1.985 9.93 4.04 320.8 0.843 0.425 0.535 0.505 7217 EMETALL 0.530 0.015 1099.1 0.523 5.92 4.72 99.8

0.145 0.020 0.060 0.055 5188 CNOUHUA 0.060 0.005 458.6 0.055 — — 40.1 0.625 0.380 0.435 0.435 7773 EPMB 0.435 -0.020 10 0.435 — — 72.2

3.048 2.150 2.400 2.400 7205 COCOLND 2.400 -0.050 1 2.400 16.57 5.42 549.1 0.920 0.415 0.560 0.540 5101 EVERGRN 0.545 0.005 3087.1 0.548 11.21 2.53 461.3

1.750 1.394 1.490 1.470 7202 CSCENIC 1.490 0.040 30.6 1.475 17.61 6.71 179.5 1.690 1.198 1.350 1.350 2984 FACBIND 1.350 -0.010 17 1.350 24.73 2.96 115.0

0.075 0.010 — — 5214 CSL 0.010 — — — — — 12.4 2.850 2.340 2.600 2.570 7229 FAVCO 2.570 UNCH 14.4 2.579 10.20 5.25 569.0

0.668 0.460 — — 9423 CWG 0.470 — — — 8.06 3.19 59.4 0.707 0.480 0.600 0.540 0149 FIBON 0.540 -0.050 88.3 0.577 49.54 2.04 52.9

0.040 0.025 0.035 0.030 7179 DBE 0.035 0.005 816 0.031 — — 93.7 2.221 1.910 1.970 1.960 3107 FIMACOR 1.960 -0.010 11 1.961 13.08 6.38 480.7

1.100 0.870 — — 7119 DEGEM 1.100 — — — 10.68 2.27 147.4 1.747 0.962 1.210 1.200 5197 FLBHD 1.210 0.020 7.5 1.205 22.08 6.61 124.9

75.730 55.076 67.000 66.960 3026 DLADY 66.960 -0.040 27.8 66.98 35.71 1.49 4,285.4 0.631 0.177 0.390 0.370 5277 FPGROUP 0.380 0.015 29328.2 0.380 22.75 2.63 197.0

0.110 0.050 0.075 0.075 7182 EKA 0.075 UNCH 140 0.075 — — 23.4 2.620 0.800 0.890 0.870 7197 GESHEN 0.880 0.010 55.2 0.879 8.84 — 70.4

0.285 0.180 0.210 0.190 9091 EMICO 0.200 0.010 276.7 0.198 — — 19.2 0.070 0.035 0.050 0.045 5220 GLOTEC 0.050 0.005 295 0.045 — — 269.1

1.630 1.000 — — 7149 ENGKAH 1.080 — — — 67.08 2.78 76.4 0.330 0.170 0.215 0.205 7192 GOODWAY 0.210 UNCH 1537.7 0.211 17.50 — 23.2

0.365 0.150 0.180 0.170 7208 EURO 0.180 UNCH 394.3 0.175 — — 48.1 0.130 0.085 0.090 0.090 7096 GPA 0.090 UNCH 57.5 0.090 — — 88.2

0.760 0.620 0.720 0.720 7094 EUROSP 0.720 UNCH 20 0.720 — — 32.0 0.355 0.220 0.270 0.260 5649 GPHAROS 0.270 0.010 82.4 0.260 7.76 — 36.3

39.980 22.958 37.900 37.480 3689 F&N 37.700 UNCH 105.2 37.70 47.86 1.53 13,827.5 0.250 0.150 — — 0136 GREENYB 0.155 — — — — 1.94 51.7

1.050 0.820 — — 2755 FCW 0.820 — — — — — 205.0 0.910 0.500 0.620 0.615 3247 GUH 0.615 -0.005 18 0.616 — 5.48 170.9

0.695 0.335 0.400 0.390 8605 FIHB 0.400 UNCH 28.3 0.395 15.75 3.00 43.6 1.180 0.710 0.900 0.880 5151 HALEX 0.900 0.020 41.1 0.883 — — 95.4

1.931 0.994 1.430 1.390 9172 FPI 1.390 -0.040 382.5 1.401 8.97 5.76 343.8 6.619 5.680 6.100 6.060 5168 HARTA 6.070 UNCH 1480.5 6.076 45.57 1.15 20,131.0

1.100 0.600 0.810 0.810 7184 G3 0.810 -0.040 10 0.810 — — 334.1 19.158 5.797 7.220 7.030 4324 HENGYUAN 7.050 0.010 1086.7 7.132 2.87 0.28 2,115.0

2.200 1.320 1.810 1.790 5102 GCB 1.800 UNCH 250.8 1.797 6.90 1.39 864.3 1.649 0.668 0.885 0.865 5095 HEVEA 0.865 0.005 2209.9 0.870 11.20 7.86 484.8

0.370 0.045 0.140 0.130 5187 HBGLOB 0.135 0.005 1546.4 0.134 4.26 — 63.2 0.966 0.650 0.680 0.675 3298 HEXZA 0.680 UNCH 28.5 0.679 — 7.35 136.3

24.020 16.875 23.200 22.700 3255 HEIM 22.980 0.280 64.6 23.06 25.73 3.92 6,942.2 0.530 0.300 0.375 0.360 5072 HIAPTEK 0.375 0.015 3008.8 0.371 — — 501.4

12.300 8.688 11.160 10.900 3301 HLIND 10.940 0.080 7.4 10.95 27.45 3.38 3,587.3 1.170 0.400 0.980 0.930 5199 HIBISCS 0.955 0.020 46608.9 0.962 13.05 — 1,516.8

0.957 0.600 0.720 0.690 5160 HOMERIZ 0.705 0.015 267.4 0.708 8.44 5.96 211.5 1.330 0.913 1.210 1.210 7033 HIGHTEC 1.210 0.010 1.3 1.210 8.61 2.89 49.1

0.380 0.300 0.330 0.325 7213 HOVID 0.325 UNCH 43.6 0.327 180.56 — 268.5 0.968 0.592 — — 8443 HIL 0.640 — — — 12.60 2.73 213.8

1.200 1.020 1.090 1.080 5024 HUPSENG 1.090 0.010 119.2 1.087 19.82 5.50 872.0 0.715 0.300 0.460 0.455 5165 HOKHENG 0.460 0.015 19.1 0.459 57.50 — 36.8

0.495 0.320 0.370 0.360 8478 HWATAI 0.360 -0.010 8.9 0.366 33.03 — 26.9 0.665 0.030 0.385 0.360 2739 HUAAN 0.380 0.020 66246.9 0.376 4.88 — 426.5

4.589 1.089 1.450 1.380 5107 IQGROUP 1.380 -0.070 58 1.401 — 7.25 121.5 2.720 0.990 1.090 1.060 5000 HUMEIND 1.070 0.010 39.5 1.063 — 1.87 512.6

1.546 0.750 0.910 0.900 7152 JAYCORP 0.900 UNCH 11.2 0.905 9.52 12.22 123.5 0.340 0.120 0.155 0.145 9601 HWGB 0.155 0.005 976 0.150 — — 50.3

0.602 0.365 0.420 0.405 8931 JERASIA 0.405 UNCH 202.6 0.405 6.12 1.23 33.2 2.350 1.634 2.200 2.190 7222 IMASPRO 2.200 0.010 244 2.190 29.77 1.59 176.0

1.576 0.881 1.090 1.060 7167 JOHOTIN 1.080 UNCH 616.1 1.074 13.69 3.24 335.3 0.290 0.110 0.145 0.135 7183 IRETEX 0.140 -0.005 1037.5 0.139 — — 20.3

1.677 0.500 0.870 0.830 5247 KAREX 0.850 0.010 2857.7 0.853 73.28 1.18 852.0 0.080 0.040 0.050 0.040 7223 JADI 0.045 0.005 8874.5 0.045 — — 42.4

3.630 1.940 2.540 2.450 7216 KAWAN 2.450 0.050 81.7 2.470 31.82 1.60 880.8 0.155 0.120 — — 8648 JASKITA 0.130 — — — — 7.69 58.4

0.210 0.100 — — 8303 KFM 0.125 — — — — — 8.5 1.110 0.950 — — 7043 JMR 1.000 — — — — 3.00 126.8

0.774 0.545 0.590 0.560 6203 KHEESAN 0.590 0.005 110.1 0.579 17.10 2.54 61.4 0.300 0.145 0.185 0.175 0054 KARYON 0.175 -0.010 399.6 0.179 7.68 1.71 83.2

2.338 1.560 — — 7062 KHIND 1.750 — — — 89.74 0.57 70.1 0.728 0.450 0.495 0.495 7199 KEINHIN 0.495 0.005 0.1 0.495 30.75 2.75 53.9

2.033 1.600 — — 0002 KOTRA 1.850 — — — 20.29 2.16 247.2 0.480 0.250 0.255 0.255 6211 KIALIM 0.255 UNCH 1 0.255 — — 15.8

0.145 0.057 0.095 0.090 5172 KSTAR 0.090 0.005 1859.2 0.090 — — 34.3 3.037 2.445 2.650 2.630 3522 KIANJOO 2.650 UNCH 6.1 2.635 14.21 1.51 1,177.0

5.352 3.200 3.800 3.700 7006 LATITUD 3.700 -0.080 22.2 3.711 12.01 3.24 359.7 2.017 1.220 1.350 1.320 5371 KIMHIN 1.320 0.020 21.3 1.339 223.73 3.79 205.4

1.090 0.710 0.800 0.710 9385 LAYHONG 0.730 -0.060 36402.5 0.743 11.87 0.68 476.9 0.045 0.005 — — 5060 KINSTEL 0.005 — — — — — 5.2

1.020 0.297 1.020 0.965 8079 LEESK 1.000 0.035 2719.8 0.995 21.10 1.50 167.8 1.175 0.780 0.840 0.840 9466 KKB 0.840 UNCH 8 0.840 48.84 2.38 216.5

4.169 2.194 2.850 2.720 7089 LIIHEN 2.720 -0.130 702 2.796 8.51 4.96 489.6 0.300 0.175 0.205 0.195 7164 KNM 0.205 0.010 17387.9 0.201 — — 485.7

0.815 0.460 0.530 0.520 7126 LONBISC 0.530 0.010 49.5 0.524 12.83 — 98.9 1.700 0.810 1.130 1.120 6971 KOBAY 1.120 0.010 25.3 1.121 13.59 — 114.3

1.641 0.885 — — 7085 LTKM 0.910 — — — 36.55 2.75 118.4 0.245 0.150 0.185 0.170 7017 KOMARK 0.170 -0.010 4199.9 0.173 — — 28.0

7.420 4.034 4.900 4.830 7087 MAGNI 4.840 -0.020 525.5 4.846 8.62 2.89 787.6 4.720 3.165 4.610 4.510 7153 KOSSAN 4.550 -0.030 3032.5 4.579 32.32 1.21 5,819.2

0.050 0.005 — — 5189 MAXWELL 0.010 — — — — — 4.0 1.000 0.415 — — 7130 KPOWER 0.550 — — — — — 41.9

1.070 0.805 0.970 0.960 5886 MBG 0.970 0.020 15 0.966 54.19 3.09 59.0 5.022 3.910 4.040 4.000 3476 KSENG 4.000 0.010 43.6 4.021 190.48 2.50 1,445.9

2.399 1.270 1.310 1.270 3662 MFLOUR 1.270 -0.020 1519.4 1.289 15.45 5.12 698.9 0.724 0.362 0.420 0.395 5192 KSSC 0.405 0.005 84.1 0.403 9.60 4.94 38.9

0.865 0.640 0.810 0.780 7935 MILUX 0.780 -0.080 5.5 0.792 — — 42.4 0.715 0.330 0.360 0.330 8362 KYM 0.360 UNCH 38.3 0.340 — — 54.0

4.300 3.360 — — 5202 MSM 3.560 — — — 140.16 3.93 2,502.6 7.080 2.920 3.340 3.300 3794 LAFMSIA 3.330 -0.030 12.6 3.331 — — 2,829.5

0.040 0.010 0.025 0.020 5150 MSPORTS 0.025 0.005 9107.2 0.025 — — 15.2 0.837 0.530 0.575 0.560 9326 LBALUM 0.575 0.015 122.2 0.573 23.47 4.35 142.9

1.730 1.250 1.720 1.720 3921 MWE 1.720 UNCH 13 1.720 — 1.16 398.3 6.192 3.968 5.210 5.150 5284 LCTITAN 5.170 -0.030 351.3 5.175 11.66 4.45 11,931.3

161.33 80.84 148.60 148.00 4707 NESTLE 148.200 -0.600 23.1 148.31 53.75 1.82 34,752.9 0.962 0.580 0.670 0.635 5232 LEONFB 0.655 0.025 212 0.650 2.60 2.29 203.1

3.978 2.832 — — 7060 NHFATT 3.080 — — — 17.23 3.25 254.6 0.365 0.210 0.215 0.210 8745 LEWEKO 0.210 -0.005 121.5 0.210 — — 67.6

0.095 0.035 0.045 0.035 7139 NICE 0.040 UNCH 261.4 0.040 — — 13.3 1.670 0.615 0.880 0.810 4235 LIONIND 0.875 0.055 9762.7 0.850 4.02 — 628.2

0.310 0.150 0.185 0.180 7215 NIHSIN 0.180 0.005 2487.8 0.181 21.43 — 57.9 0.740 0.340 0.425 0.390 9881 LSTEEL 0.415 0.010 416.5 0.413 7.57 — 53.1

0.774 0.490 0.595 0.580 5066 NTPM 0.590 UNCH 183.3 0.587 21.77 3.39 662.7 0.140 0.075 0.095 0.085 5068 LUSTER 0.090 UNCH 1775.5 0.090 33.33 — 177.8

1.697 0.830 0.930 0.880 7107 OFI 0.880 -0.010 189.6 0.891 18.84 3.98 211.2 4.561 2.936 3.250 3.220 9199 LYSAGHT 3.220 -0.030 7 3.229 7.98 2.17 133.9

6.415 5.798 6.260 6.210 4006 ORIENT 6.230 0.040 32.7 6.246 9.89 3.21 3,865.1 1.400 0.515 0.730 0.675 5098 MASTEEL 0.730 0.050 24749.7 0.709 4.02 1.23 311.9

6.180 3.481 6.140 5.940 7052 PADINI 5.960 -0.220 547.8 5.959 24.43 1.68 3,921.1 0.755 0.531 0.595 0.595 7029 MASTER 0.595 -0.015 5 0.595 6.92 3.36 32.5

40.631 33.000 37.580 37.300 3719 PANAMY 37.580 0.440 131.1 37.51 17.40 3.11 2,282.8 1.392 0.905 1.000 0.980 5152 MBL 1.000 0.030 134.7 0.992 10.91 1.00 101.1

0.558 0.340 — — 5022 PAOS 0.350 — — — 63.64 4.57 63.4 0.835 0.650 0.760 0.745 7004 MCEHLDG 0.745 -0.005 15.8 0.754 — — 33.1

0.480 0.260 0.320 0.300 9407 PARAGON 0.320 0.010 20.4 0.308 — — 22.4 0.325 0.165 0.205 0.180 3778 MELEWAR 0.190 UNCH 2197.3 0.195 — — 85.7

0.401 0.200 0.240 0.235 6068 PCCS 0.240 UNCH 394.5 0.237 4.97 — 50.4 0.730 0.510 — — 5223 MENTIGA 0.520 — — — 108.33 1.92 36.4

0.880 0.575 0.625 0.625 5231 PELIKAN 0.625 0.030 0.1 0.625 13.92 — 345.8 1.750 1.545 — — 6149 METROD 1.750 — — — 8.86 3.43 210.0

0.707 0.540 0.595 0.570 9997 PENSONI 0.570 -0.030 85.2 0.570 11.42 3.51 73.9 1.235 0.370 0.485 0.470 5001 MIECO 0.480 0.010 2183.3 0.479 7.14 2.08 252.0

0.210 0.150 0.160 0.160 4081 PMCORP 0.160 UNCH 53 0.160 — — 123.7 0.170 0.075 0.090 0.085 7219 MINETEC 0.085 UNCH 272 0.085 — — 74.9

0.781 0.480 — — 5080 POHKONG 0.510 — — — 7.28 1.96 209.3 0.573 0.380 0.450 0.435 5576 MINHO 0.450 0.005 115.6 0.438 8.82 1.67 98.9

1.999 1.122 1.480 1.450 7088 POHUAT 1.460 UNCH 171.2 1.462 7.07 4.79 340.5 4.169 2.677 3.660 3.550 5916 MSC 3.620 0.030 133 3.621 45.14 1.10 362.0

17.324 13.390 16.800 16.600 4065 PPB 16.720 -0.060 403.4 16.73 22.94 1.50 23,785.9 2.884 1.115 1.950 1.880 3883 MUDA 1.890 -0.020 560.6 1.913 10.24 1.85 576.5

0.605 0.400 — — 7190 PPG 0.430 — — — — 4.65 43.0 0.850 0.340 0.440 0.410 5087 MYCRON 0.435 0.025 541.6 0.428 5.45 — 123.3

1.274 0.550 0.710 0.695 8966 PRLEXUS 0.700 UNCH 183.2 0.701 8.57 3.21 126.2 0.355 0.090 0.145 0.130 5025 NWP 0.135 UNCH 3539.8 0.137 — — 53.0

1.133 0.795 0.890 0.890 7134 PWF 0.890 0.015 5.9 0.890 7.94 3.85 154.4 1.105 0.610 0.730 0.710 4944 NYLEX 0.710 UNCH 61.3 0.718 6.72 2.82 138.0

1.852 0.947 1.520 1.480 7237 PWROOT 1.500 -0.020 547.1 1.494 61.98 4.45 602.4 1.897 1.100 1.290 1.260 7140 OKA 1.260 UNCH 433.7 1.268 8.36 4.37 206.1

6.100 3.820 6.050 5.990 7084 QL 6.000 -0.050 676.9 6.014 43.42 0.55 9,734.6 1.738 1.079 1.290 1.260 5065 ORNA 1.270 UNCH 198.9 1.277 6.15 3.94 95.6

0.628 0.420 — — 9946 REX 0.480 — — — — 1.04 118.4 0.130 0.043 0.055 0.055 7225 PA 0.055 UNCH 1010.5 0.055 — — 93.7

1.532 0.446 0.610 0.590 0183 SALUTE 0.595 0.020 7004.7 0.599 15.70 4.03 230.9 8.900 6.650 8.850 8.800 5183 PCHEM 8.810 0.010 11598 8.812 18.14 3.06 70,480.0

0.960 0.300 0.375 0.360 5252 SASBADI 0.370 0.005 2395.1 0.370 20.00 1.81 155.1 1.640 0.780 0.875 0.845 5271 PECCA 0.855 -0.025 2375.5 0.861 15.30 5.85 160.7

0.590 0.350 0.380 0.360 5157 SAUDEE 0.380 0.020 42 0.370 26.39 — 50.3 7.695 3.360 4.730 4.490 5436 PERSTIM 4.730 0.250 81.7 4.648 20.75 6.34 469.7

0.707 0.480 0.610 0.590 7180 SERNKOU 0.610 -0.005 166 0.598 16.14 — 146.4 19.096 15.492 18.500 18.380 6033 PETGAS 18.38 -0.020 547.9 18.45 20.06 3.65 36,369.1

1.340 0.590 0.740 0.740 7165 SGB 0.740 0.005 41 0.740 — — 147.0 14.620 6.796 8.100 8.010 3042 PETRONM 8.050 0.050 86 8.061 5.89 3.11 2,173.5

1.480 0.680 0.790 0.790 7412 SHH 0.790 0.005 10 0.790 — 6.33 39.5 1.510 1.310 — — 3611 PGLOBE 1.350 — — — — — 252.0

0.933 0.480 0.620 0.595 7246 SIGN 0.600 0.010 1070.1 0.606 7.02 4.17 144.2 2.257 1.186 1.670 1.620 7095 PIE 1.630 -0.040 243.6 1.633 14.34 1.47 626.0

0.750 0.200 0.250 0.250 8532 SINOTOP 0.250 UNCH 105.9 0.250 — — 98.7 3.480 0.986 3.360 3.270 7172 PMBTECH 3.270 -0.030 34 3.291 50.31 0.61 523.2

0.685 0.420 — — 9776 SMCAP 0.450 — — — 2.26 — 27.5 5.782 2.574 4.460 4.320 8869 PMETAL 4.440 -0.020 1231.2 4.407 28.12 1.35 17,178.3

0.335 0.240 — — 7943 SNC 0.270 — — — — — 17.8 0.550 0.460 — — 6637 PNEPCB 0.515 — — — 39.02 — 67.7

2.460 2.076 2.350 2.350 7103 SPRITZER 2.350 UNCH 8.8 2.350 16.48 2.34 493.5 0.700 0.355 0.445 0.435 8117 POLY 0.445 0.025 37.5 0.443 39.38 — 71.2

1.067 0.725 0.820 0.795 7186 SWSCAP 0.820 UNCH 107.9 0.804 24.26 — 149.5 0.950 0.540 0.590 0.575 8273 PPHB 0.580 -0.010 226.4 0.580 7.73 — 109.4

0.526 0.260 0.330 0.325 7082 SYF 0.325 UNCH 202.2 0.325 — 4.62 201.3 1.410 0.783 0.920 0.895 9873 PRESTAR 0.920 0.025 79.8 0.902 4.38 5.43 188.4

0.470 0.280 — — 7211 TAFI 0.280 — — — — — 22.4 1.080 0.755 0.805 0.790 7168 PRG 0.800 UNCH 344.3 0.800 56.34 0.63 246.6

1.899 1.283 1.790 1.770 4405 TCHONG 1.770 -0.010 189.1 1.779 — 1.13 1,189.4 0.113 0.051 0.080 0.070 7123 PWORTH 0.075 UNCH 52264.7 0.076 11.03 — 307.1

0.579 0.270 0.285 0.275 7200 TEKSENG 0.275 -0.005 390.7 0.281 4.89 7.27 95.7 1.200 0.720 — — 7544 QUALITY 0.820 — — — — — 47.5

1.080 0.800 0.870 0.865 7252 TEOSENG 0.865 -0.005 111.1 0.869 17.58 1.73 259.5 0.660 0.390 — — 7498 RALCO 0.390 — — — — — 18.0

1.445 0.880 — — 9369 TGL 0.970 — — — 8.58 5.15 39.5 5.950 5.310 5.950 5.870 7765 RAPID 5.950 0.110 355 5.925 187.11 — 636.0

1.004 0.500 — — 7230 TOMEI 0.550 — — — 5.36 1.82 76.2 0.510 0.240 0.290 0.265 5256 REACH 0.275 0.010 4150 0.280 — — 301.5

0.485 0.330 — — 7176 TPC 0.350 — — — 18.13 — 81.8 0.580 0.285 0.320 0.320 7232 RESINTC 0.320 -0.005 55.8 0.320 23.19 3.75 43.9

6.926 4.664 6.200 6.120 4588 UMW 6.180 -0.040 309.7 6.167 149.64 0.81 7,220.1 1.554 1.020 1.150 1.140 9741 ROHAS 1.150 0.010 190.8 1.144 17.72 1.74 543.6

2.594 2.310 2.400 2.400 7757 UPA 2.400 0.050 1 2.400 5.26 3.33 191.0 0.824 0.521 0.600 0.595 7803 RUBEREX 0.595 0.005 37 0.595 11.04 2.94 150.1

2.404 1.246 1.380 1.340 7203 WANGZNG 1.380 UNCH 13 1.346 20.51 2.90 220.8 4.927 3.710 3.980 3.940 5134 SAB 3.940 -0.020 12.2 3.962 16.51 1.27 539.5

0.210 0.115 0.175 0.160 5156 XDL 0.170 UNCH 7784.5 0.169 21.25 — 296.1 8.214 5.708 7.150 7.100 9822 SAM 7.100 -0.150 10 7.105 14.81 1.97 959.7

0.665 0.525 0.545 0.540 7121 XIANLNG 0.540 -0.005 50.5 0.540 — — 43.2 0.957 0.740 0.840 0.840 7811 SAPIND 0.840 0.020 5 0.840 20.24 4.76 61.1

0.065 0.035 — — 5155 XINQUAN 0.055 — — — — — 26.7 1.120 0.390 0.465 0.445 5170 SCABLE 0.465 0.005 33 0.454 — 6.45 147.4

2.395 1.984 2.240 2.210 5584 YEELEE 2.210 -0.010 62 2.227 10.07 2.04 423.4 3.307 1.210 1.430 1.410 7247 SCGM 1.430 0.010 481.2 1.418 15.12 4.20 276.8

1.496 0.993 1.230 1.230 5159 YOCB 1.230 UNCH 67.8 1.230 8.32 4.07 196.8 0.810 0.500 0.655 0.630 9237 SCIB 0.655 UNCH 21.4 0.651 80.86 — 56.3

3.103 2.267 2.840 2.740 7178 YSPSAH 2.800 0.060 261.1 2.805 20.83 2.50 386.4 9.603 6.420 8.050 7.880 4731 SCIENTX 8.000 0.100 186.1 8.004 14.15 2.50 3,911.4

2.082 1.350 1.490 1.470 5131 ZHULIAN 1.480 -0.010 39.7 1.479 14.44 4.73 680.8 0.350 0.240 0.280 0.270 7239 SCNWOLF 0.280 0.010 233.6 0.270 6.91 — 26.9

INDUSTRIAL PRODUCTS 1.470 0.425 0.460 0.435 7073 SEACERA 0.455 0.015 3795.9 0.454 36.99 — 170.9

1.364 0.910 0.970 0.960 0012 3A 0.970 0.005 16.7 0.963 12.60 1.86 477.2 0.210 0.120 0.155 0.145 5145 SEALINK 0.145 -0.005 148.4 0.146 — — 72.5

0.180 0.085 0.105 0.095 7086 ABLEGRP 0.100 0.005 776.9 0.099 — — 26.4 0.670 0.320 0.345 0.335 5163 SEB 0.345 0.010 100 0.340 14.81 — 27.6

0.430 0.300 — — 7131 ACME 0.305 — — — 20.61 — 72.8 1.393 0.780 0.800 0.800 5181 SIGGAS 0.800 UNCH 30 0.800 32.92 1.00 150.0

0.975 0.450 0.530 0.490 7191 ADVENTA 0.530 UNCH 14.6 0.490 68.83 — 81.0 0.870 0.500 0.630 0.550 7115 SKBSHUT 0.630 0.120 16.1 0.603 12.19 — 25.2

2.235 1.780 2.050 1.950 9148 ADVPKG 2.010 0.230 20.8 1.981 25.00 4.48 41.2 2.350 1.267 1.520 1.490 7155 SKPRES 1.500 UNCH 2037.4 1.503 14.49 2.77 1,875.3

0.190 0.125 0.135 0.135 7146 AEM 0.135 UNCH 429 0.135 — — 40.4 2.093 0.805 — — 7248 SLP 1.070 — — — 17.66 4.21 339.1

0.580 0.370 0.385 0.380 5198 AFUJIYA 0.380 UNCH 6 0.382 10.08 — 68.4 0.625 0.390 — — 7132 SMISCOR 0.510 — — — — — 22.8

0.485 0.260 — — 2682 AISB 0.310 — — — 5.10 — 44.8 2.525 1.320 1.770 1.700 5665 SSTEEL 1.770 0.050 694.4 1.752 4.22 1.98 767.5

0.820 0.491 0.555 0.550 7609 AJIYA 0.555 UNCH 140 0.552 29.52 1.80 169.0 0.280 0.115 — — 7143 STONE 0.135 — — — — — 12.1

0.250 0.032 0.170 0.145 9954 AKNIGHT 0.170 0.020 6937.3 0.158 — — 98.1 1.370 0.860 0.880 0.880 6904 SUBUR 0.880 UNCH 2.1 0.880 — — 183.9

1.566 0.700 0.780 0.730 2674 ALCOM 0.780 0.050 187.4 0.760 10.55 26.28 104.8 1.889 0.757 0.900 0.855 7207 SUCCESS 0.895 0.055 97.7 0.883 9.02 2.79 222.4

* Volume Weighted Average Price # PE is calculated based on latest 12 months reported Earnings Per Share