Page 16 - Jignyasa-June 2020

P. 16

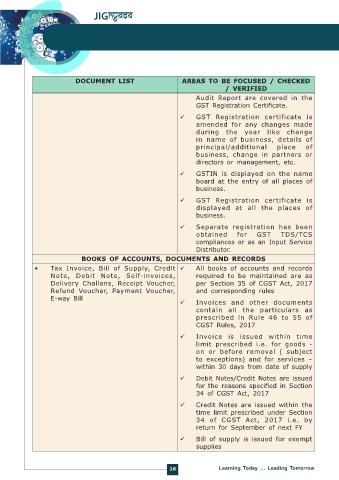

DOCUMENT LIST AREAS TO BE FOCUSED / CHECKED

/ VERIFIED

Audit Report are covered in the

GST Registration Certificate.

GST Registration certificate is

amended for any changes made

during the year like change

in name of business, details of

principal/additional place of

business, change in partners or

directors or management, etc.

GSTIN is displayed on the name

board at the entry of all places of

business.

GST Registration certificate is

displayed at all the places of

business.

Separate registration has been

obtained for GST TDS/TCS

compliances or as an Input Service

Distributor.

BOOKS OF ACCOUNTS, DOCUMENTS AND RECORDS

• Tax Invoice, Bill of Supply, Credit All books of accounts and records

Note, Debit Note, Self-invoices, required to be maintained are as

Delivery Challans, Receipt Voucher, per Section 35 of CGST Act, 2017

Refund Voucher, Payment Voucher, and corresponding rules

E-way Bill

Invoices and other documents

contain all the particulars as

prescribed in Rule 46 to 55 of

CGST Rules, 2017

Invoice is issued within time

limit prescribed i.e. for goods -

on or before removal ( subject

to exceptions) and for services –

within 30 days from date of supply

Debit Notes/Credit Notes are issued

for the reasons specified in Section

34 of CGST Act, 2017

Credit Notes are issued within the

time limit prescribed under Section

34 of CGST Act, 2017 i.e. by

return for September of next FY

Bill of supply is issued for exempt

supplies

16 Learning Today … Leading Tomorrow