Page 20 - Jignyasa-June 2020

P. 20

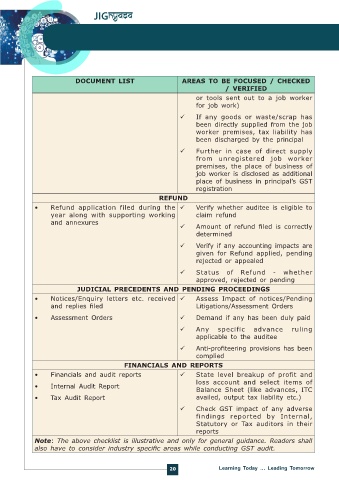

DOCUMENT LIST AREAS TO BE FOCUSED / CHECKED

/ VERIFIED

or tools sent out to a job worker

for job work)

If any goods or waste/scrap has

been directly supplied from the job

worker premises, tax liability has

been discharged by the principal

Further in case of direct supply

from unregistered job worker

premises, the place of business of

job worker is disclosed as additional

place of business in principal’s GST

registration

REFUND

• Refund application filed during the Verify whether auditee is eligible to

year along with supporting working claim refund

and annexures

Amount of refund filed is correctly

determined

Verify if any accounting impacts are

given for Refund applied, pending

rejected or appealed

Status of Refund - whether

approved, rejected or pending

JUDICIAL PRECEDENTS AND PENDING PROCEEDINGS

• Notices/Enquiry letters etc. received Assess Impact of notices/Pending

and replies filed Litigations/Assessment Orders

• Assessment Orders Demand if any has been duly paid

Any specific advance ruling

applicable to the auditee

Anti-profiteering provisions has been

complied

FINANCIALS AND REPORTS

• Financials and audit reports State level breakup of profit and

loss account and select items of

• Internal Audit Report

Balance Sheet (like advances, ITC

• Tax Audit Report availed, output tax liability etc.)

Check GST impact of any adverse

findings reported by Internal,

Statutory or Tax auditors in their

reports

Note: The above checklist is illustrative and only for general guidance. Readers shall

also have to consider industry specific areas while conducting GST audit.

20 Learning Today … Leading Tomorrow