Page 19 - Jignyasa-June 2020

P. 19

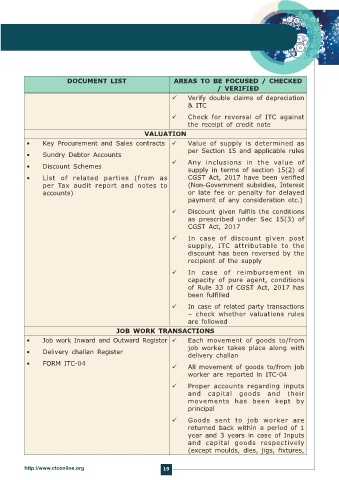

DOCUMENT LIST AREAS TO BE FOCUSED / CHECKED

/ VERIFIED

Verify double claims of depreciation

& ITC

Check for reversal of ITC against

the receipt of credit note

VALUATION

• Key Procurement and Sales contracts Value of supply is determined as

per Section 15 and applicable rules

• Sundry Debtor Accounts

Any inclusions in the value of

• Discount Schemes supply in terms of section 15(2) of

• List of related parties (from as CGST Act, 2017 have been verified

per Tax audit report and notes to (Non-Government subsidies, Interest

accounts) or late fee or penalty for delayed

payment of any consideration etc.)

Discount given fulfils the conditions

as prescribed under Sec 15(3) of

CGST Act, 2017

In case of discount given post

supply, ITC attributable to the

discount has been reversed by the

recipient of the supply

In case of reimbursement in

capacity of pure agent, conditions

of Rule 33 of CGST Act, 2017 has

been fulfilled

In case of related party transactions

– check whether valuations rules

are followed

JOB WORK TRANSACTIONS

• Job work Inward and Outward Register Each movement of goods to/from

job worker takes place along with

• Delivery challan Register

delivery challan

• FORM ITC-04

All movement of goods to/from job

worker are reported in ITC-04

Proper accounts regarding inputs

and capital goods and their

movements has been kept by

principal

Goods sent to job worker are

returned back within a period of 1

year and 3 years in case of Inputs

and capital goods respectively

(except moulds, dies, jigs, fixtures,

http://www.ctconline.org 19