Page 17 - Jignyasa-June 2020

P. 17

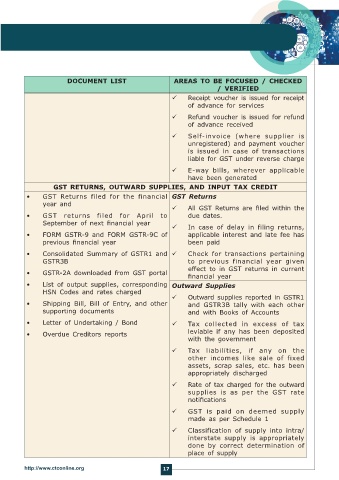

DOCUMENT LIST AREAS TO BE FOCUSED / CHECKED

/ VERIFIED

Receipt voucher is issued for receipt

of advance for services

Refund voucher is issued for refund

of advance received

Self-invoice (where supplier is

unregistered) and payment voucher

is issued in case of transactions

liable for GST under reverse charge

E-way bills, wherever applicable

have been generated

GST RETURNS, OUTWARD SUPPLIES, AND INPUT TAX CREDIT

• GST Returns filed for the financial GST Returns

year and

All GST Returns are filed within the

• GST returns filed for April to due dates.

September of next financial year

In case of delay in filing returns,

• FORM GSTR-9 and FORM GSTR-9C of applicable interest and late fee has

previous financial year been paid

• Consolidated Summary of GSTR1 and Check for transactions pertaining

GSTR3B to previous financial year given

effect to in GST returns in current

• GSTR-2A downloaded from GST portal

financial year

• List of output supplies, corresponding Outward Supplies

HSN Codes and rates charged

Outward supplies reported in GSTR1

• Shipping Bill, Bill of Entry, and other and GSTR3B tally with each other

supporting documents and with Books of Accounts

• Letter of Undertaking / Bond Tax collected in excess of tax

• Overdue Creditors reports leviable if any has been deposited

with the government

Tax liabilities, if any on the

other incomes like sale of fixed

assets, scrap sales, etc. has been

appropriately discharged

Rate of tax charged for the outward

supplies is as per the GST rate

notifications

GST is paid on deemed supply

made as per Schedule 1

Classification of supply into intra/

interstate supply is appropriately

done by correct determination of

place of supply

http://www.ctconline.org 17