Page 19 - Forbes India (December 2015)

P. 19

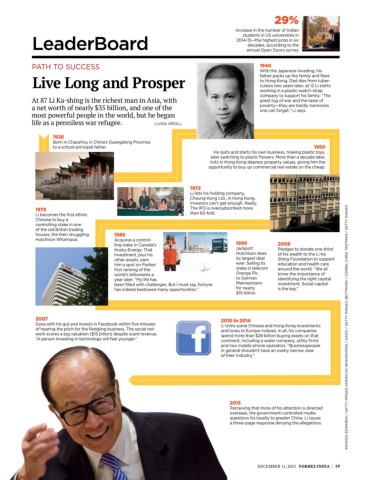

29%

Increase in the number of Indian

LeaderBoard 2014-15—the highest jump in six

students in US universities in

decades, according to the

annual Open Doors survey

Path tO SUcceSS 1940

with the Japanese invading, his

Live Long and Prosper father packs up the family and flees

to hong kong. Dad dies from tuber-

culosis two years later; at 12 li starts

working in a plastic-watch-strap

company to support his family. “the

At 87 Li Ka-shing is the richest man in Asia, with great tug of war and the taste of

a net worth of nearly $35 billion, and one of the poverty—they are hardly memories

one can forget,” li says.

most powerful people in the world, but he began

life as a penniless war refugee. -lUISa krOll

1928

Born in chaozhou in china’s guangdong Province

to a school-principal father. 1950

he quits and starts his own business, making plastic toys,

later switching to plastic flowers. more than a decade later,

riots in hong kong depress property values, giving him the

opportunity to buy up commercial real estate on the cheap.

1972

li lists his holding company,

cheung kong ltd., in hong kong.

Investors can’t get enough. really.

1979 the IPO is oversubscribed more

li becomes the first ethnic than 65-fold.

chinese to buy a

controlling stake in one

of the old British trading

houses, the then struggling 1986

hutchison whampoa. acquires a control-

ling stake in canada’s 1999 2006

husky energy. that Jackpot! Pledges to donate one-third

investment, plus his hutchison does of his wealth to the li ka

other assets, earn its largest deal Shing Foundation to support

him a spot on Forbes’ ever: Selling its education and health care

first ranking of the stake in telecom around the world. “we all

world’s billionaires a Orange Plc. know the importance of

year later. “my life has to german identifying the right capital

been filled with challenges. But I must say, fortune mannesmann investment. Social capital

has indeed bestowed many opportunities.” for nearly is the key.”

$15 billion.

2007 2010 to 2014

goes with his gut and invests in Facebook within five minutes li trims some chinese and hong kong investments

of hearing the pitch for the fledgling business. the social net- and looks to europe instead. In all, his companies amanDa eDwarDS / getty ImageS amerIcan newSPaPerS / gaDO / getty ImageS; Bettmann / cOrBIS; chrIS trOtman / getty ImageS

work scores a big valuation ($15 billion) despite scant revenue. spend more than $28 billion buying assets on that

“a person investing in technology will feel younger.” continent, including a water company, utility firms

and two mobile phone operators. “Businesspeople

in general shouldn’t have an overly narrow view

of their industry.”

2015

Perceiving that more of his attention is directed

overseas, the government-controlled media

questions his loyalty to greater china. li issues

a three-page response denying the allegations.

DECEMBER 11, 2015 FORBES INDIA | 19