Page 61 - Forbes - Asia (April 2019)

P. 61

Kalanick recruited Droege, with whom he had cofound- team of nearly 2,000 remained mostly unscathed. He admits

ed a file-sharing startup as undergraduates at UCLA, in it was a “tough year,” but he told his team to keep their heads

March 2014 to head what was loosely called Uber Every- down and execute.

thing. His mandate: Find a service that could become as big What’s most exciting to Uber executives is that many Eats

as ride-hailing. Droege tried delivering everything from di- customers don’t even use the ride-hailing service: Last year,

apers and deodorant to daisies and dry cleaning. Nothing four of every ten people who used Eats were new to Uber,

worked—except food. giving the company access to fresh customers who might

After a few stunts like delivering ice cream and BBQ on later be convinced to give the car service a try.

the Fourth of July, Uber made its first serious attempt with “Of all the side bets that Uber has made over the years,

Uber Fresh. Fresh had drivers circling city blocks with cool- whether it’s autonomous or delivering other things or dif-

ers full of soups and sandwiches ready for delivery with- ferent modalities of transportation, this has come out as the

in minutes. On launch day in Los Angeles in August 2014, clear number one in scale and executive attention,” says Mike

the Uber team sold hundreds of meals in an hour and a half, Ghaffary, the former CEO of delivery rival Eat24.

a giant leap from the eight orders a day for deodorant. “The Eats is closing in on Grubhub, still the U.S. market leader.

signal spike was big,” Droege says. In 2016, Grubhub controlled over half the market, says Wed-

It was the right market but the wrong product. Magical as bush analyst Ygal Arounian. Its market share dropped to 34%

it was to have a driver show up with a burrito in 5 minutes at in 2018, while Eats’ grew from 3% to 24%. “The pace of their

the tap of an app, Droege realized customers would wait 30 expansion has caught everyone off guard,” Arounian says.

minutes if they could order any meal they wanted. Internal- But the tailwinds helping Eats, such as a generation turn-

ly the team quietly started work on Project Agora (Greek for ing to their phones first when hungry, also propelled its oppo-

marketplace) to launch Uber Eats. They started in Toronto in nents. In 2018, DoorDash raised about $1 billion in venture

2015, chosen because competition was lighter than in a city funding and nearly tripled its valuation to $4 billion. Post-

like New York, and then expanded to Miami, Houston and mates also raised $400 million in the last six months of 2018

secondary cities like Tacoma, Washington. A couple of mar- and now has a valuation of $1.9 billion. Both competitors also

kets (Miami and Atlanta) became profitable in 2017, proving benefit from their single-minded focus on food delivery.

that the business was possible, at least in certain places. To trim costs, Uber Eats batches orders so a driver can

But just as Uber Eats was getting traction, Uber’s executive pick up multiple meals at once. It’s also enticing customers

team fell apart in the wake of reports of sexual harassment, with free delivery from restaurants that already have a courier

gender discrimination and questionable business ethics. Ul- en route. But Khosrowshahi draws the line when it comes to

timately, Kalanick was ousted, and other groups, like self- pairing passengers with pad thai: “We don’t want your experi-

driving cars, lost their department heads. But Droege and his ence to suffer because it may be good for our business.”

To grow further, Uber Eats needs to

win over more customers and restaurants.

Droege is betting partnerships with Mc-

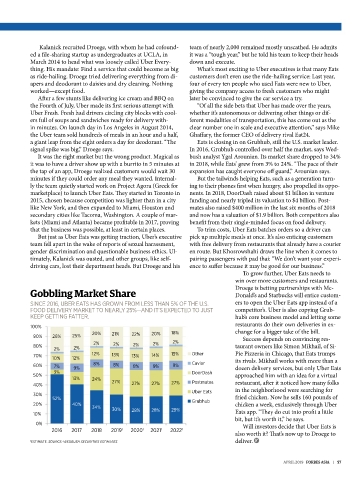

Gobbling Market Share Donald’s and Starbucks will entice custom-

SINCE 2016, UBER EATS HAS GROWN FROM LESS THAN 5% OF THE U.S. ers to open the Uber Eats app instead of a

FOOD DELIVERY MARKET TO NEARLY 25%—AND IT’S EXPECTED TO JUST competitor’s. Uber is also copying Grub-

KEEP GETTING FATTER. hub’s core business model and letting some

restaurants do their own deliveries in ex-

100%

20% 21% 22% 20% 18% change for a bigger take of the bill.

90% 26% 25% Success depends on convincing res-

2% 2% 2% 2%

80% 2% taurant owners like Simon Mikhail, of Si-

2% 2%

70% 12% 13% 13% 14% 15% Other Pie Pizzeria in Chicago, that Eats trumps

10% 12% its rivals. Mikhail works with more than a

60% 7% 9% 8% 8% 8% 9% 9% Caviar dozen delivery services, but only Uber Eats

3% DoorDash

50% approached him with an idea for a virtual

13% 24%

40% 27% 27% 27% 27% Postmates restaurant, after it noticed how many folks

Uber Eats in the neighborhood were searching for

30%

52% fried chicken. Now he sells 160 pounds of

20% 40% Grubhub chicken a week, exclusively through Uber

34%

30% 28% 28% 29%

10% Eats app. “They do cut into profit a little

bit, but it’s worth it,” he says.

0%

Will investors decide that Uber Eats is

2016 2017 2018 2019 1 2020 1 2021 1 2022 1

also worth it? That’s now up to Droege to

1 ESTIMATE. SOURCE: WEDBUSH SECURITIES ESTIMATES. deliver. F

APRIL 2019 FORBES ASIA | 57