Page 195 - (DK) The Business Book

P. 195

WORKING WITH A VISION 193

See also: Study the competition 24–27 ■ Protect the core business 170–71 ■ Good and bad strategy 184–85 ■ Porter’s five

forces 212–15 ■ The value chain 216–17 ■ Product portfolio 250–55 ■ Ansoff’s matrix 256–57

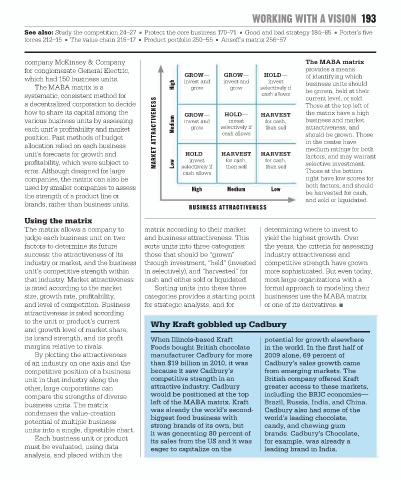

company McKinsey & Company The MABA matrix

for conglomerate General Electric, provides a means

GROW— GROW— HOLD— of identifying which

which had 150 business units. invest and invest and invest

The MABA matrix is a High grow grow selectively if business units should

be grown, held at their

systematic, consistent method for cash allows current level, or sold.

a decentralized corporation to decide Those at the top left of

how to share its capital among the GROW— HOLD— HARVEST the matrix have a high

various business units by assessing Medium invest and invest for cash, business and market

each unit’s profitability and market MARKET ATTRACTIVENESS grow selectively if then sell attractiveness, and

cash allows

position. Past methods of budget should be grown. Those

in the center have

allocation relied on each business medium ratings for both

unit’s forecasts for growth and HOLD— HARVEST HARVEST factors, and may warrant

invest

profitability, which were subject to Low selectively if for cash, for cash, selective investment.

then sell

then sell

error. Although designed for large cash allows Those at the bottom

companies, the matrix can also be right have low scores for

used by smaller companies to assess High Medium Low both factors, and should

the strength of a product line or be harvested for cash,

and sold or liquidated.

brands, rather than business units.

BUSINESS ATTRACTIVENESS

Using the matrix

The matrix allows a company to matrix according to their market determining where to invest to

judge each business unit on two and business attractiveness. This yield the highest growth. Over

factors to determine its future sorts units into three categories: the years, the criteria for assessing

success: the attractiveness of its those that should be “grown” industry attractiveness and

industry or market, and the business through investment, “held” (invested competitive strength have grown

unit’s competitive strength within in selectively), and “harvested” for more sophisticated. But even today,

that industry. Market attractiveness cash and either sold or liquidated. most large organizations with a

is rated according to the market Sorting units into these three formal approach to modeling their

size, growth rate, profitability, categories provides a starting point businesses use the MABA matrix

and level of competition. Business for strategic analysis, and for or one of its derivatives. ■

attractiveness is rated according

to the unit or product’s current Why Kraft gobbled up Cadbury

and growth level of market share,

its brand strength, and its profit When Illinois-based Kraft potential for growth elsewhere

margins relative to rivals. Foods bought British chocolate in the world. In the first half of

By plotting the attractiveness manufacturer Cadbury for more 2009 alone, 69 percent of

of an industry on one axis and the than $19 billion in 2010, it was Cadbury’s sales growth came

competitive position of a business because it saw Cadbury’s from emerging markets. The

unit in that industry along the competitive strength in an British company offered Kraft

other, large corporations can attractive industry. Cadbury greater access to these markets,

compare the strengths of diverse would be positioned at the top including the BRIC economies—

left of the MABA matrix. Kraft Brazil, Russia, India, and China.

business units. The matrix

was already the world’s second- Cadbury also had some of the

condenses the value-creation

biggest food business with world’s leading chocolate,

potential of multiple business

strong brands of its own, but candy, and chewing gum

units into a single, digestible chart.

it was generating 80 percent of brands. Cadbury’s Chocolate,

Each business unit or product

its sales from the US and it was for example, was already a

must be evaluated, using data eager to capitalize on the leading brand in India.

analysis, and placed within the