Page 18 - REC :: MBA CURRICULUM AND SYLLABUS :: R2019

P. 18

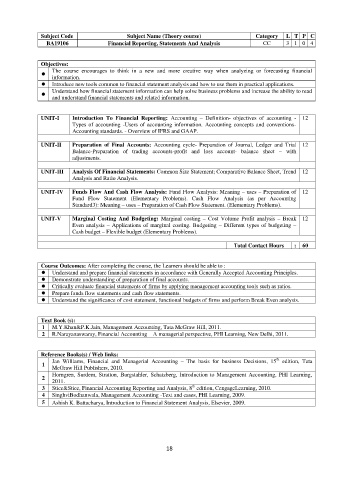

Subject Code Subject Name (Theory course) Category L T P C

BA19106 Financial Reporting, Statements And Analysis CC 3 1 0 4

Objectives:

The course encourages to think in a new and more creative way when analyzing or forecasting financial

information.

Introduce new tools common to financial statement analysis and how to use them in practical applications.

Understand how financial statement information can help solve business problems and increase the ability to read

and understand financial statements and related information.

UNIT-I Introduction To Financial Reporting: Accounting – Definition- objectives of accounting - 12

Types of accounting -Users of accounting information. Accounting concepts and conventions-

Accounting standards. - Overview of IFRS and GAAP.

UNIT-II Preparation of Final Accounts: Accounting cycle- Preparation of Journal, Ledger and Trial 12

Balance-Preparation of trading accounts-profit and loss account- balance sheet – with

adjustments.

UNIT-III Analysis Of Financial Statements: Common Size Statement; Comparative Balance Sheet, Trend 12

Analysis and Ratio Analysis.

UNIT-IV Funds Flow And Cash Flow Analysis: Fund Flow Analysis: Meaning – uses – Preparation of 12

Fund Flow Statement (Elementary Problems). Cash Flow Analysis (as per Accounting

Standard3): Meaning – uses – Preparation of Cash Flow Statement. (Elementary Problems).

UNIT-V Marginal Costing And Budgeting: Marginal costing – Cost Volume Profit analysis – Break 12

Even analysis – Applications of marginal costing. Budgeting – Different types of budgeting –

Cash budget – Flexible budget (Elementary Problems).

Total Contact Hours : 60

Course Outcomes: After completing the course, the Learners should be able to :

Understand and prepare financial statements in accordance with Generally Accepted Accounting Principles.

Demonstrate understanding of preparation of final accounts.

Critically evaluate financial statements of firms by applying management accounting tools such as ratios.

Prepare funds flow statements and cash flow statements.

Understand the significance of cost statement, functional budgets of firms and perform Break Even analysis.

Text Book (s):

1 M.Y.Khan&P.K.Jain, Management Accounting, Tata McGraw Hill, 2011.

2 R.Narayanaswamy, Financial Accounting – A managerial perspective, PHI Learning, New Delhi, 2011.

Reference Books(s) / Web links:

th

Jan Williams, Financial and Managerial Accounting – The basis for business Decisions, 15 edition, Tata

1

McGraw Hill Publishers, 2010.

Horngren, Surdem, Stratton, Burgstahler, Schatzberg, Introduction to Management Accounting, PHI Learning,

2

2011.

th

3 Stice&Stice, Financial Accounting Reporting and Analysis, 8 edition, CengageLearning, 2010.

4 SinghviBodhanwala, Management Accounting -Text and cases, PHI Learning, 2009.

5 Ashish K. Battacharya, Introduction to Financial Statement Analysis, Elsevier, 2009.

18