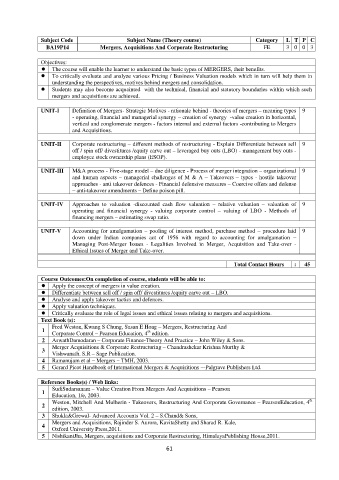

Page 61 - REC :: MBA CURRICULUM AND SYLLABUS :: R2019

P. 61

Subject Code Subject Name (Theory course) Category L T P C

BA19P14 Mergers, Acquisitions And Corporate Restructuring FE 3 0 0 3

Objectives:

The course will enable the learner to understand the basic types of MERGERS, their benefits.

To critically evaluate and analyze various Pricing / Business Valuation models which in turn will help them in

understanding the perspectives, motives behind mergers and consolidation.

Students may also become acquainted with the technical, financial and statutory boundaries within which such

mergers and acquisitions are achieved.

UNIT-I Definition of Mergers- Strategic Motives - rationale behind - theories of mergers – meaning types 9

- operating, financial and managerial synergy – creation of synergy -value creation in horizontal,

vertical and conglomerate mergers - factors internal and external factors -contributing to Mergers

and Acquisitions.

UNIT-II Corporate restructuring – different methods of restructuring - Explain Differentiate between sell 9

off / spin off/ divestitures /equity carve out – leveraged buy outs (LBO) - management buy outs -

employee stock ownership plans (ESOP).

UNIT-III M&A process - Five-stage model – due diligence - Process of merger integration – organizational 9

and human aspects – managerial challenges of M & A – Takeovers – types - hostile takeover

approaches - anti takeover defences - Financial defensive measures – Coercive offers and defense

– anti-takeover amendments – Define poison pill.

UNIT-IV Approaches to valuation -discounted cash flow valuation – relative valuation – valuation of 9

operating and financial synergy - valuing corporate control – valuing of LBO - Methods of

financing mergers – estimating swap ratio.

UNIT-V Accounting for amalgamation – pooling of interest method, purchase method – procedure laid 9

down under Indian companies act of 1956 with regard to accounting for amalgamation –

Managing Post-Merger Issues - Legalities Involved in Merger, Acquisition and Take-over -

Ethical Issues of Merger and Take-over.

Total Contact Hours : 45

Course Outcomes:On completion of course, students will be able to:

Apply the concept of mergers in value creation.

Differentiate between sell off / spin off/ divestitures /equity carve out – LBO.

Analyse and apply takeover tactics and defences.

Apply valuation techniques.

Critically evaluate the role of legal issues and ethical issues relating to mergers and acquisitions.

Text Book (s):

Fred Weston, Kwang S Chung, Susan E Hoag – Mergers, Restructuring And

1 th

Corporate Control – Pearson Education, 4 edition.

2 AswathDamodaran – Corporate Finance-Theory And Practice – John Wiley & Sons.

Merger Acquisitions & Corporate Restructuring – Chandrashekar Krishna Murthy &

3

Vishwanath. S.R – Sage Publication.

4 Ramanujam et al – Mergers – TMH, 2003.

5 Gerard Picot Handbook of International Mergers & Acquisitions –-Palgrave Publishers Ltd.

Reference Books(s) / Web links:

SudiSudarsanam – Value Creation From Mergers And Acquisitions – Pearson

1

Education, 1/e, 2003.

th

Weston, Mitchell And Mulherin - Takeovers, Restructuring And Corporate Governance – PearsonEducation, 4

2

edition, 2003.

3 Shukla&Grewal- Advanced Accounts Vol. 2 – S.Chand& Sons,

Mergers and Acquisitions, Rajinder S. Aurora, KavitaShetty and Sharad R. Kale,

4

Oxford University Press,2011.

5 NishikantJha, Mergers, acquisitions and Corporate Restructuring, HimalayaPublishing House,2011.

61