Page 17 - ANC20-Proceedings-Presentations-Full

P. 17

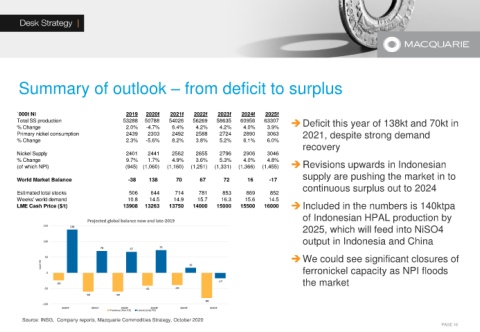

Summary of outlook – from deficit to surplus

`000t Ni 2019 2020f 2021f 2022f 2023f 2024f 2025f

Total SS production 53288 50788 54026 56269 58635 60956 63307 ➔Deficit this year of 138kt and 70kt in

% Change 2.0% -4.7% 6.4% 4.2% 4.2% 4.0% 3.9%

Primary nickel consumption 2439 2303 2492 2588 2724 2890 3063 2021, despite strong demand

% Change 2.3% -5.6% 8.2% 3.8% 5.2% 6.1% 6.0%

recovery

Nickel Supply 2401 2441 2562 2655 2796 2906 3046

% Change 9.7% 1.7% 4.9% 3.6% 5.3% 4.0% 4.8%

(of which NPI) (945) (1,060) (1,160) (1,251) (1,331) (1,366) (1,455) ➔Revisions upwards in Indonesian

supply are pushing the market in to

World Market Balance -38 138 70 67 72 16 -17

continuous surplus out to 2024

Estimated total stocks 506 644 714 781 853 869 852

Weeks' world demand 10.8 14.5 14.9 15.7 16.3 15.6 14.5

LME Cash Price ($/t) 13908 13263 13750 14000 15000 15500 16000 ➔Included in the numbers is 140ktpa

of Indonesian HPAL production by

Projected global balance now and late-2019

2025, which will feed into NiSO4

150 138

output in Indonesia and China

100

70 67 72

50 ➔We could see significant closures of

'ooot Ni 16

0 ferronickel capacity as NPI floods

-17 the market

-24

-50 -41 -39

-60 -60

-80

-100

2020F 2021F 2022F 2023F 2024F 2025F

Previous (Dec-19) Latest (July-20)

Source: INSG, Company reports, Macquarie Commodities Strategy, October 2020

PAGE 16