Page 14 - ANC20-Proceedings-Presentations-Full

P. 14

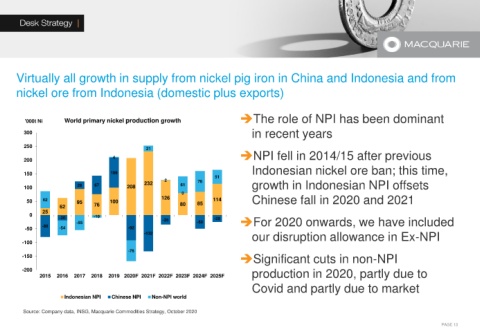

Virtually all growth in supply from nickel pig iron in China and Indonesia and from

nickel ore from Indonesia (domestic plus exports)

'000t Ni World primary nickel production growth ➔The role of NPI has been dominant

300 in recent years

250 21

4 ➔NPI fell in 2014/15 after previous

200

Indonesian nickel ore ban; this time,

150 109 51

2 76

232

100 28 67 208 61 growth in Indonesian NPI offsets

0

50 62 95 100 126 85 114 Chinese fall in 2020 and 2021

62 76 80

25

0 -10

-20 -35 -25

-55 -50 ➔For 2020 onwards, we have included

-50 -80 -54 -92

-132 our disruption allowance in Ex-NPI

-100

-76

-150 ➔Significant cuts in non-NPI

-200 production in 2020, partly due to

2015 2016 2017 2018 2019 2020F 2021F 2022F 2023F 2024F 2025F

Covid and partly due to market

Indonesian NPI Chinese NPI Non-NPI world

Source: Company data, INSG, Macquarie Commodities Strategy, October 2020

PAGE 13