Page 4 - ANC20-Proceedings-Presentations-Full

P. 4

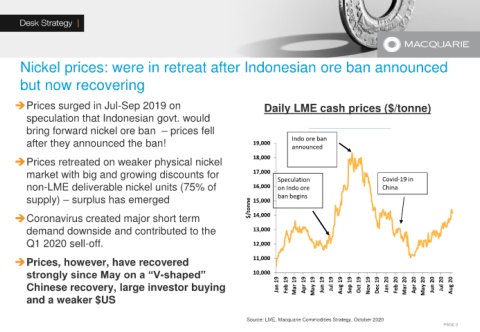

Nickel prices: were in retreat after Indonesian ore ban announced

but now recovering

➔Prices surged in Jul-Sep 2019 on Daily LME cash prices ($/tonne)

speculation that Indonesian govt. would

bring forward nickel ore ban – prices fell Ore ban announced

after they announced the ban! 19,000 Indo ore ban

announced

➔Prices retreated on weaker physical nickel 18,000 Speculation on ore ban

market with big and growing discounts for 17,000 Speculation Covid-19 in

non-LME deliverable nickel units (75% of 16,000 on Indo ore China

supply) – surplus has emerged $/tonne 15,000 ban begins

➔Coronavirus created major short term 14,000

demand downside and contributed to the 13,000

Q1 2020 sell-off. 12,000

➔Prices, however, have recovered 11,000

strongly since May on a “V-shaped” 10,000

Chinese recovery, large investor buying Jan 19 Feb 19 Mar 19 Apr 19 May 19 Jun 19 Jul 19 Aug 19 Sep 19 Oct 19 Nov 19 Dec 19 Jan 20 Feb 20 Mar 20 Apr 20 May 20 Jun 20 Jul 20 Aug 20

and a weaker $US

Source: LME, Macquarie Commodities Strategy, October 2020

PAGE 3