Page 25 - Spotlight A+ Form 4 & 5 Mathematics KSSM

P. 25

Form

Chapter 10 Consumer Mathematics: Financial Management Mathematics 4

10.1 Financial Planning and Example 1

Management Match each of the following.

Describe effective financial management Pay car installment for every

process month.

1. Financial planning is a process of evaluating Give six months salary as Needs

the current and future financial status of an yearly bonus.

individual or organisation by using the sources

©PAN ASIA PUBLICATIONS

of incomes and expenditures to determine the Provide lunch to all workers. Wants

cash flow, asset value and financial plan of the

future.

2. Financial management is a process involving Buy personal Takaful

insurance.

the use of sources of incomes and assets on

the expenditures, savings, investments and Solution:

protection to fulfil the financial goals of an

individual or organisation. Pay car installment for every

month.

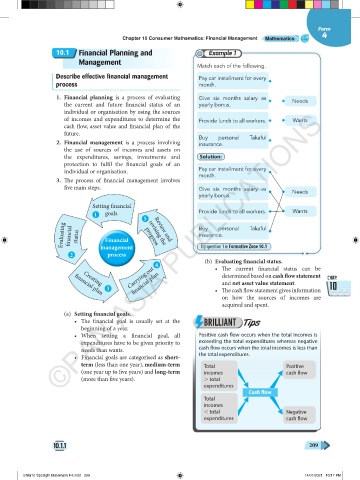

3. The process of financial management involves

five main steps. Give six months salary as

yearly bonus. Needs

Setting financial

1 goals Provide lunch to all workers. Wants

5

Evaluating financial status Financial progress Buy personal Takaful

insurance.

Review and

revising the

process

2 management Try question 1 in Formative Zone 10.1

(b) Evaluating financial status.

4 • The current financial status can be

Carrying out determined based on cash flow statement CHAP.

and net asset value statement.

Creating

3 financial plan • The cash flow statement gives information 10

financial plan

on how the sources of incomes are

acquired and spent.

(a) Setting financial goals.

• The financial goal is usually set at the BRILLIANT Tips

beginning of a year.

• When setting a financial goal, all Positive cash flow occurs when the total incomes is

expenditures have to be given priority to exceeding the total expenditures whereas negative

needs than wants. cash flow occurs when the total incomes is less than

• Financial goals are categorised as short- the total expenditures.

term (less than one year), medium-term Total Positive

(one year up to five years) and long-term incomes cash flow

(more than five years). . total

expenditures

Cash flow

Total

incomes

, total Negative

expenditures cash flow

10.1.1 209

ENG10 Spotlight Matematik F4.indd 209 14/01/2021 10:17 PM