Page 47 - Georgetown Retail Merchandising Plan 11.7.16 - FINAL

P. 47

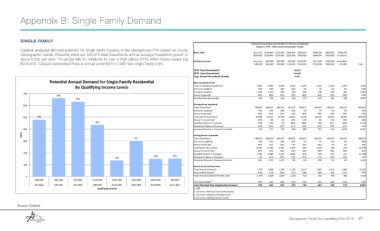

Appendix B: Single Family Demand

SINGLE FAMILY

Estimated Annual Demand Potential For Purchase Residential

Based on 2015 - 2020 County Demographic Trends

Catalyst analyzed demand potential for single family housing in the Georgetown PTA based on county

less than $100,000 $150,000 $200,000 $250,000

$500,000

demographic trends. Presently there are 180,875 total households and an average household growth of Home Value $100,000 $150,000 $200,000 $250,000 $300,000 $300,000 $400,000 and above

$500,000

$400,000

about 6,000 per year. The propensity for residents to own is high (above 87%) when house values top Qualifying Income less than $40,000 $65,000 $90,000 $110,000 $125,000 $150,000 more than

$200,000. Catalyst determined there is annual potential for 2,943 new single family units. $40,000 $65,000 $90,000 $110,000 $125,000 $150,000 $200,000 200,000 Total

2016 Total Households 1 180,875

2021 Total Households 1 210,849

Avg. Annual Household Growth 5,995

Poten4al Annual Demand for Single-Family Residen4al New Household Growth

By Qualifying Income Levels Total Annual New Households 1 5,995 5,995 5,995 5,995 5,995 5,995 5,995 5,995 5,995

23%

19%

6%

92%

6%

% Income Qualified

16%

7%

10%

5%

# Income Qualified 1,379 1,139 959 599 300 420 360 360 5,515

700

660 Owner Propensity 43% 62% 67% 93% 90% 87% 93% 94% 69%

631 Qualified New Households 593 706 643 558 270 365 335 338 3,807

600 Existing Owner Household

Total Households 1 180,875 180,875 180,875 180,875 180,875 180,875 180,875 180,875 180,875

% Income Qualified 2 23% 19% 16% 10% 5% 7% 6% 6% 92%

Owner Propensity 2 43% 62% 67% 93% 90% 87% 93% 94% 64%

500 479 Total Owner Households 17,889 21,307 19,390 16,821 8,139 11,015 10,093 10,201 114,856

Annual Turnover Rate 2 10% 8% 4% 10% 13% 9% 12% 19% 10%

435 Qualified Owners in Turnover 1789 1705 776 1682 1058 991 1211 1938 11150

Estimated % Rent vs. Purchase 3 18% 28% 42% 51% 65% 95% 78% 84% 55%

400 Estimated Owners in Turnover that Rent 322 477 326 858 688 942 945 1,628 6,185

Units 301 Existing Renter Households

1

300 Total Households 2 180,875 180,875 180,875 180,875 180,875 180,875 180,875 180,875 180,875

16%

23%

19%

10%

6%

92%

6%

5%

7%

% Income Qualified

Renter Propensity 2 56% 37% 32% 17% 10% 12% 7% 5% 29%

Total Renter Households 23,297 12,716 9,261 3,075 904 1,519 760 543 52,074

Annual Turnover Rate 2 42% 40% 35% 54% 29% 55% 28% 40% 41%

200 Qualified Renters in Turnover 9,785 5,086 3,241 1,660 262 836 213 217 21,300

149 152 3

136 Estimated % Rent vs. Purchase 9% 26% 40% 47% 57% 67% 58% 60% 25%

Estimated Renters in Turnover that Rent 881 1,322 1,297 780 149 560 123 130 5,243

100

Income Qualified Households

Total Potential Demand 1,795 2,506 2,265 2,196 1,107 1,867 1,403 2,096 15,235

Percent New Renters 3 82% 81% 86% 61% 38% 50% 33% 22% 59%

0 Total Potential Demand for New Units 1,474 2,029 1,939 1,338 419 925 458 468 9,050

$40,000 $65,000 $90,000 $110,000 $125,000 $150,000 $200,000 200,000

City Capture Rate 3,4 33% 33% 33% 33% 33% 33% 33% 33% 33%

less than $40,000 $65,000 $90,000 $110,000 $125,000 $150,000 more than Total Potential New Singlefamily Demand 479 660 631 435 136 301 149 152 2,943

Qualifying Income 1. ESRI

2. US Census American Community Survey

3. US Census American Housing Survey

4. US Census Building Permits Survey

Source: Catalyst

Georgetown Retail Merchandising Plan 2016 47