Page 48 - Georgetown Retail Merchandising Plan 11.7.16 - FINAL

P. 48

Appendix C: Multi-Family Demand

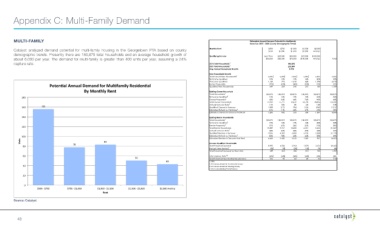

MULTI-FAMILY Estimated Annual Demand Potential for Multifamily

Based on 2015 - 2020 County Demographic Trends

Catalyst analyzed demand potential for multi-family housing in the Georgetown PTA based on county Monthly Rent $500 $1,000 $1,000 $1,500 And Up

$2,000

$750

$2,000

$750

$1,500

demographic trends. Presently there are 180,875 total households and an average household growth of Qualifying Income Less Than $35,000 $50,000 $75,000 $100,000

about 6,000 per year. The demand for multi-family is greater than 400 units per year, assuming a 24% $35,000 $50,000 $75,000 $100,000 And Up Total

capture rate. 2016 Total Households 1 180,875

2021 Total Households 1 210,849

Avg. Annual Household Growth 5,995

New Household Growth

Total Annual New Households 1 5,995 5,995 5,995 5,995 5,995 5,995

% Income Qualified 19% 12% 17% 14% 30% 92%

# Income Qualified 1,139 719 1,019 839 1,798 5,515

Poten+al Annual Demand for Mul+family Residen+al Renter Propensity 57% 45% 34% 25% 10% 1,709

31%

Qualified New Households

346

324

180

210

649

By Monthly Rent Existing Owner Household

Total Households 1 180,875 180,875 180,875 180,875 180,875 180,875

180 % Income Qualified 2 19% 12% 17% 14% 30% 92%

Owner Propensity 2 42% 54% 64% 74% 90% 63%

Total Owner Households 14,434 11,721 19,679 18,739 48,836 113,409

Annual Turnover Rate 2 11% 10% 5% 6% 13% 10%

160 156 Qualified Owners in Turnover 1588 1172 984 1124 6349 11217

Estimated % Rent vs. Purchase 3 81% 71% 34% 27% 25% 39%

Estimated Owners in Turnover that Rent 1,286 832 335 304 1,587 4,344

140 Existing Renter Households

Total Households 1 180,875 180,875 180,875 180,875 180,875 180,875

% Income Qualified 2 19% 12% 17% 14% 30% 92%

Renter Propensity 2 57% 45% 34% 25% 10% 29%

120

Total Renter Households 19,589 9,767 10,455 6,331 5,426 51,567

Annual Turnover Rate 2 40% 45% 33% 49% 44% 41%

Qualified Renters in Turnover 7,836 4,395 3,450 3,102 2,388 21,170

85%

44%

65%

69%

78%

100 Estimated % Rent vs. Purchase 3 6,660 3,428 2,243 1,365 38% 14,603

Estimated Renters in Turnover that Rent

907

Units 83 Income Qualified Households

80 78 Total Potential Demand 8,595 4,584 2,924 1,878 2,674 20,656

Percent New Renters 3 8% 7% 12% 11% 7% 8%

Total Potential Demand for New Units 649 324 346 210 180 1,709

60 City Capture Rate 3,4 24% 24% 24% 24% 24% 24%

50 Total Potential New Multifamily Demand 156 78 83 50 43 410

43 1. ESRI

2. US Census American Community Survey

40 3. US Census American Housing Survey

4. US Census Building Permits Survey

20

0

$500 - $750 $750 - $1,000 $1,000 - $1,500 $1,500 - $2,000 $2,000 And Up

Rent

Source: Catalyst

48