Page 111 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 111

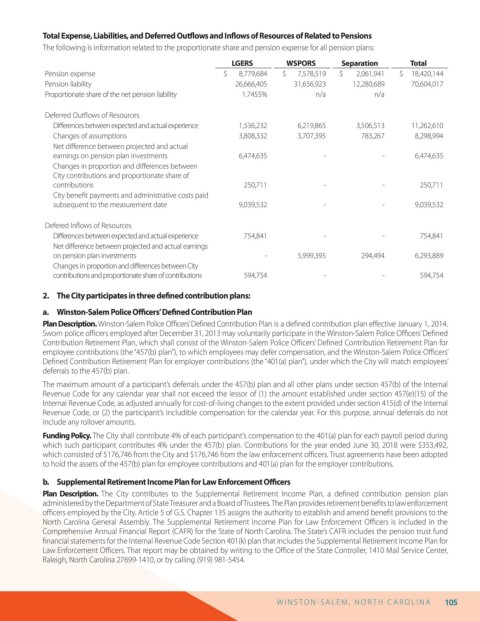

Total Expense, Liabilities, and Deferred Out ows and In ows of Resources of Related to Pensions

The following is information related to the proportionate share and pension expense for all pension plans:

LGERS WSPORS Separation Total

Pension expense $ 8,779,684 $ 7,578,519 $ 2,061,941 $ 18,420,144

Pension liability 26,666,405 31,656,923 12,280,689 70,604,017

Proportionate share of the net pension liability 1.7455% n/a n/a

Deferred Out ows of Resources

Di erences between expected and actual experience 1,536,232 6,219,865 3,506,513 11,262,610

Changes of assumptions 3,808,332 3,707,395 783,267 8,298,994

Net di erence between projected and actual

earnings on pension plan investments 6,474,635 - - 6,474,635

Changes in proportion and di erences between

City contributions and proportionate share of

contributions 250,711 - - 250,711

City bene t payments and administrative costs paid

subsequent to the measurement date 9,039,532 - - 9,039,532

Defered In ows of Resources

Di erences between expected and actual experience 754,841 - - 754,841

Net di erence between projected and actual earnings

on pension plan investments - 5,999,395 294,494 6,293,889

Changes in proportion and di erences between City

contributions and proportionate share of contributions 594,754 - - 594,754

2. The City participates in three de ned contribution plans:

a. Winston-Salem Police O cers’ De ned Contribution Plan

Plan Description. Winston-Salem Police O cers’ De ned Contribution Plan is a de ned contribution plan e ective January 1, 2014.

Sworn police o cers employed after December 31, 2013 may voluntarily participate in the Winston-Salem Police O cers’ De ned

Contribution Retirement Plan, which shall consist of the Winston-Salem Police O cers’ De ned Contribution Retirement Plan for

employee contributions (the “457(b) plan”), to which employees may defer compensation, and the Winston-Salem Police O cers’

De ned Contribution Retirement Plan for employer contributions (the “401(a) plan”), under which the City will match employees’

deferrals to the 457(b) plan.

The maximum amount of a participant’s deferrals under the 457(b) plan and all other plans under section 457(b) of the Internal

Revenue Code for any calendar year shall not exceed the lessor of (1) the amount established under section 457(e)(15) of the

Internal Revenue Code, as adjusted annually for cost-of-living changes to the extent provided under section 415(d) of the Internal

Revenue Code, or (2) the participant’s includible compensation for the calendar year. For this purpose, annual deferrals do not

include any rollover amounts.

Funding Policy. The City shall contribute 4% of each participant’s compensation to the 401(a) plan for each payroll period during

which such participant contributes 4% under the 457(b) plan. Contributions for the year ended June 30, 2018 were $353,492,

which consisted of $176,746 from the City and $176,746 from the law enforcement o cers. Trust agreements have been adopted

to hold the assets of the 457(b) plan for employee contributions and 401(a) plan for the employer contributions.

b. Supplemental Retirement Income Plan for Law Enforcement O cers

Plan Description. The City contributes to the Supplemental Retirement Income Plan, a de ned contribution pension plan

administered by the Department of State Treasurer and a Board of Trustees. The Plan provides retirement bene ts to law enforcement

o cers employed by the City. Article 5 of G.S. Chapter 135 assigns the authority to establish and amend bene t provisions to the

North Carolina General Assembly. The Supplemental Retirement Income Plan for Law Enforcement O cers is included in the

Comprehensive Annual Financial Report (CAFR) for the State of North Carolina. The State’s CAFR includes the pension trust fund

nancial statements for the Internal Revenue Code Section 401(k) plan that includes the Supplemental Retirement Income Plan for

Law Enforcement O cers. That report may be obtained by writing to the O ce of the State Controller, 1410 Mail Service Center,

Raleigh, North Carolina 27699-1410, or by calling (919) 981-5454.

W I N S T O N S AL E M , N O R T H C AR O L I N A 105