Page 109 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 109

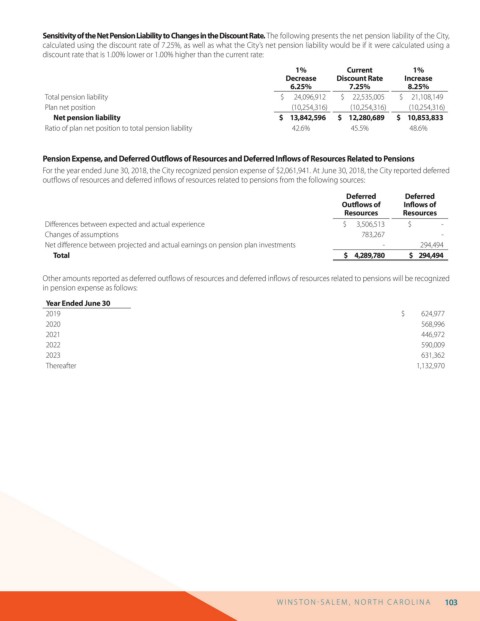

Sensitivity of the Net Pension Liability to Changes in the Discount Rate. The following presents the net pension liability of the City,

calculated using the discount rate of 7.25%, as well as what the City’s net pension liability would be if it were calculated using a

discount rate that is 1.00% lower or 1.00% higher than the current rate:

1% Current 1%

Decrease Discount Rate Increase

6.25% 7.25% 8.25%

Total pension liability $ 24,096,912 $ 22,535,005 $ 21,108,149

Plan net position (10,254,316) (10,254,316) (10,254,316)

Net pension liability $ 13,842,596 $ 12,280,689 $ 10,853,833

Ratio of plan net position to total pension liability 42.6% 45.5% 48.6%

Pension Expense, and Deferred Out ows of Resources and Deferred In ows of Resources Related to Pensions

For the year ended June 30, 2018, the City recognized pension expense of $2,061,941. At June 30, 2018, the City reported deferred

out ows of resources and deferred in ows of resources related to pensions from the following sources:

Deferred Deferred

Out ows of In ows of

Resources Resources

Di erences between expected and actual experience $ 3,506,513 $ -

Changes of assumptions 783,267 -

Net di erence between projected and actual earnings on pension plan investments - 294,494

Total $ 4,289,780 $ 294,494

Other amounts reported as deferred out ows of resources and deferred in ows of resources related to pensions will be recognized

in pension expense as follows:

Year Ended June 30

2019 $ 624,977

2020 568,996

2021 446,972

2022 590,009

2023 631,362

Thereafter 1,132,970

W I N S T O N S AL E M , N O R T H C AR O L I N A 103