Page 106 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 106

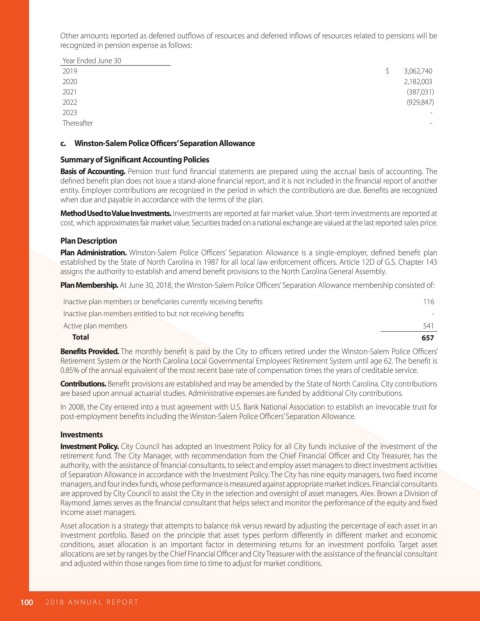

Other amounts reported as deferred out ows of resources and deferred in ows of resources related to pensions will be

recognized in pension expense as follows:

Year Ended June 30

2019 $ 3,062,740

2020 2,182,003

2021 (387,031)

2022 (929,847)

2023 -

Thereafter -

c. Winston-Salem Police O cers’ Separation Allowance

Summary of Signi cant Accounting Policies

Basis of Accounting. Pension trust fund nancial statements are prepared using the accrual basis of accounting. The

de ned bene t plan does not issue a stand-alone nancial report, and it is not included in the nancial report of another

entity. Employer contributions are recognized in the period in which the contributions are due. Bene ts are recognized

when due and payable in accordance with the terms of the plan.

Method Used to Value Investments. Investments are reported at fair market value. Short-term investments are reported at

cost, which approximates fair market value. Securities traded on a national exchange are valued at the last reported sales price.

Plan Description

Plan Administration. Winston-Salem Police O cers’ Separation Allowance is a single-employer, de ned bene t plan

established by the State of North Carolina in 1987 for all local law enforcement o cers. Article 12D of G.S. Chapter 143

assigns the authority to establish and amend bene t provisions to the North Carolina General Assembly.

Plan Membership. At June 30, 2018, the Winston-Salem Police O cers’ Separation Allowance membership consisted of:

Inactive plan members or bene ciaries currently receiving bene ts 116

Inactive plan members entitled to but not receiving bene ts -

Active plan members 541

Total 657

Benefits Provided. The monthly bene t is paid by the City to o cers retired under the Winston-Salem Police O cers’

Retirement System or the North Carolina Local Governmental Employees’ Retirement System until age 62. The bene t is

0.85% of the annual equivalent of the most recent base rate of compensation times the years of creditable service.

Contributions. Bene t provisions are established and may be amended by the State of North Carolina. City contributions

are based upon annual actuarial studies. Administrative expenses are funded by additional City contributions.

In 2008, the City entered into a trust agreement with U.S. Bank National Association to establish an irrevocable trust for

post-employment bene ts including the Winston-Salem Police O cers’ Separation Allowance.

Investments

Investment Policy. City Council has adopted an Investment Policy for all City funds inclusive of the investment of the

retirement fund. The City Manager, with recommendation from the Chief Financial O cer and City Treasurer, has the

authority, with the assistance of nancial consultants, to select and employ asset managers to direct investment activities

of Separation Allowance in accordance with the Investment Policy. The City has nine equity managers, two xed income

managers, and four index funds, whose performance is measured against appropriate market indices. Financial consultants

are approved by City Council to assist the City in the selection and oversight of asset managers. Alex. Brown a Division of

Raymond James serves as the nancial consultant that helps select and monitor the performance of the equity and xed

income asset managers.

Asset allocation is a strategy that attempts to balance risk versus reward by adjusting the percentage of each asset in an

investment portfolio. Based on the principle that asset types perform di erently in di erent market and economic

conditions, asset allocation is an important factor in determining returns for an investment portfolio. Target asset

allocations are set by ranges by the Chief Financial O cer and City Treasurer with the assistance of the nancial consultant

and adjusted within those ranges from time to time to adjust for market conditions.

100 2018 AN NUAL R E P O R T