Page 174 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 174

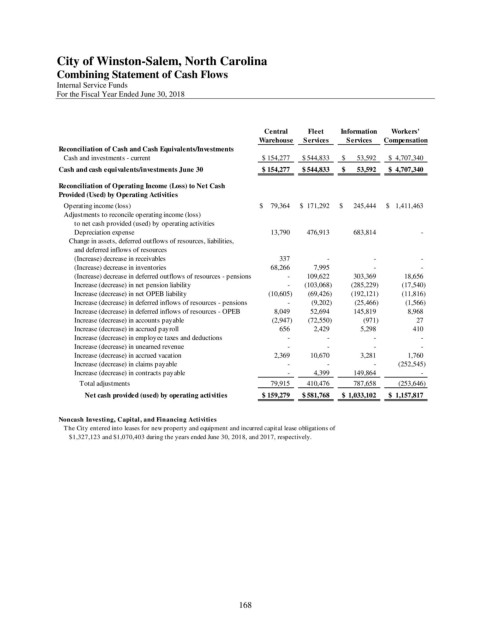

City of Winston-Salem, North Carolina

Combining Statement of Cash Flows

Internal Service Funds

For the Fiscal Year Ended June 30, 2018

Central Fleet Information Workers'

Warehouse Services Services Compensation

Reconciliation of Cash and Cash Equivalents/Investments

Cash and investments - current $ 154,277 $ 544,833 $ 53,592 $ 4,707,340

Cash and cash equivalents/investments June 30 $ 154,277 $ 544,833 $ 53,592 $ 4,707,340

Reconciliation of Operating Income (Loss) to Net Cash

Provided (Used) by Operating Activities

Operating income (loss) $ 79,364 $ 171,292 $ 245,444 $ 1,411,463

Adjustments to reconcile operating income (loss)

to net cash provided (used) by operating activities

Depreciation expense 13,790 476,913 683,814 -

Change in assets, deferred outflows of resources, liabilities,

and deferred inflows of resources

(Increase) decrease in receivables 337 - - -

(Increase) decrease in inventories 68,266 7,995 - -

(Increase) decrease in deferred outflows of resources - pensions - 109,622 303,369 18,656

Increase (decrease) in net pension liability - (103,068) (285,229) (17,540)

Increase (decrease) in net OPEB liability (10,605) (69,426) (192,121) (11,816)

Increase (decrease) in deferred inflows of resources - pensions - (9,202) (25,466) (1,566)

Increase (decrease) in deferred inflows of resources - OPEB 8,049 52,694 145,819 8,968

Increase (decrease) in accounts payable (2,947) (72,550) (971) 27

Increase (decrease) in accrued payroll 656 2,429 5,298 410

Increase (decrease) in employee taxes and deductions - - - -

Increase (decrease) in unearned revenue - - - -

Increase (decrease) in accrued vacation 2,369 10,670 3,281 1,760

Increase (decrease) in claims payable - - - (252,545)

Increase (decrease) in contracts payable - 4,399 149,864 -

Total adjustments 79,915 410,476 787,658 (253,646)

Net cash provided (used) by operating activities $ 159,279 $ 581,768 $ 1,033,102 $ 1,157,817

Noncash Investing, Capital, and Financing Activities

The City entered into leases for new property and equipment and incurred capital lease obligations of

$1,327,123 and $1,070,403 during the years ended June 30, 2018, and 2017, respectively.

168