Page 198 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 198

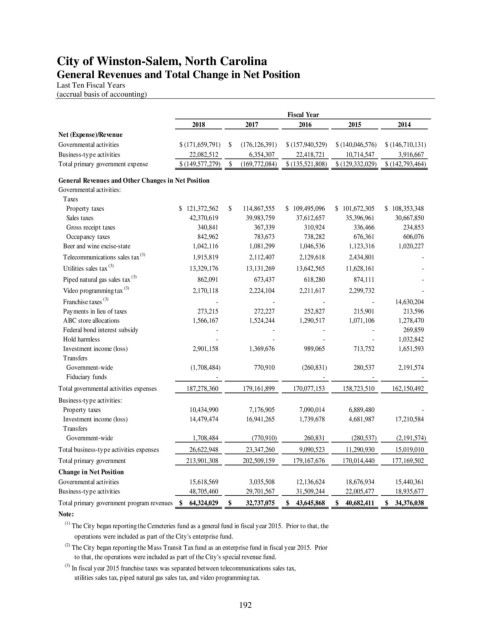

City of Winston-Salem, North Carolina

General Revenues and Total Change in Net Position

Last Ten Fiscal Years

(accrual basis of accounting)

Fiscal Year

2018 2017 2016 2015 2014

Net (Expense)/Revenue

Governmental activities $ (171,659,791) $ (176,126,391) $ (157,940,529) $ (140,046,576) $ (146,710,131)

Business-type activities 22,082,512 6,354,307 22,418,721 10,714,547 3,916,667

Total primary government expense $ (149,577,279) $ (169,772,084) $ (135,521,808) $ (129,332,029) $ (142,793,464)

General Revenues and Other Changes in Net Position

Governmental activities:

Taxes

Property taxes $ 121,372,562 $ 114,867,555 $ 109,495,096 $ 101,672,305 $ 108,353,348

Sales taxes 42,370,619 39,983,759 37,612,657 35,396,961 30,667,850

Gross receipt taxes 340,841 367,339 310,924 336,466 234,853

Occupancy taxes 842,962 783,673 738,282 676,361 606,076

Beer and wine excise-state 1,042,116 1,081,299 1,046,536 1,123,316 1,020,227

Telecommunications sales tax (3) 1,915,819 2,112,407 2,129,618 2,434,801 -

Utilities sales tax (3) 13,329,176 13,131,269 13,642,565 11,628,161 -

Piped natural gas sales tax (3) 862,091 673,437 618,280 874,111 -

Video programming tax (3) 2,170,118 2,224,104 2,211,617 2,299,732 -

Franchise taxes (3) - - - - 14,630,204

Payments in lieu of taxes 273,215 272,227 252,827 215,901 213,596

ABC store allocations 1,566,167 1,524,244 1,290,517 1,071,106 1,278,470

Federal bond interest subsidy - - - - 269,859

Hold harmless - - - - 1,032,842

Investment income (loss) 2,901,158 1,369,676 989,065 713,752 1,651,593

Transfers

Government-wide (1,708,484) 770,910 (260,831) 280,537 2,191,574

Fiduciary funds - - - -

Total governmental activities expenses 187,278,360 179,161,899 170,077,153 158,723,510 162,150,492

Business-type activities:

Property taxes 10,434,990 7,176,905 7,090,014 6,889,480 -

Investment income (loss) 14,479,474 16,941,265 1,739,678 4,681,987 17,210,584

Transfers

Government-wide 1,708,484 (770,910) 260,831 (280,537) (2,191,574)

Total business-type activities expenses 26,622,948 23,347,260 9,090,523 11,290,930 15,019,010

Total primary government 213,901,308 202,509,159 179,167,676 170,014,440 177,169,502

Change in Net Position

Governmental activities 15,618,569 3,035,508 12,136,624 18,676,934 15,440,361

Business-type activities 48,705,460 29,701,567 31,509,244 22,005,477 18,935,677

Total primary government program revenues $ 64,324,029 $ 32,737,075 $ 43,645,868 $ 40,682,411 $ 34,376,038

Note:

(1)

The City began reporting the Cemeteries fund as a general fund in fiscal year 2015. Prior to that, the

operations were included as part of the City's enterprise fund.

(2) The City began reporting the Mass Transit Tax fund as an enterprise fund in fiscal year 2015. Prior

to that, the operations were included as part of the City's special revenue fund.

(3) In fiscal year 2015 franchise taxes was separated between telecommunications sales tax,

utilities sales tax, piped natural gas sales tax, and video programming tax.

192