Page 211 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 211

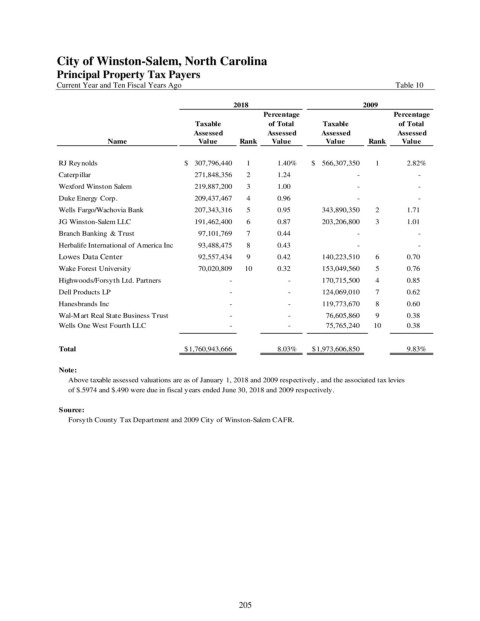

City of Winston-Salem, North Carolina

Principal Property Tax Payers

Current Year and Ten Fiscal Years Ago Table 10

2018 2009

Percentage Percentage

Taxable of Total Taxable of Total

Assessed Assessed Assessed Assessed

Name Value Rank Value Value Rank Value

RJ Reynolds $ 307,796,440 1 1.40% $ 566,307,350 1 2.82%

Caterpillar 271,848,356 2 1.24 - -

Wexford Winston Salem 219,887,200 3 1.00 - -

Duke Energy Corp. 209,437,467 4 0.96 - -

Wells Fargo/Wachovia Bank 207,343,316 5 0.95 343,890,350 2 1.71

JG Winston-Salem LLC 191,462,400 6 0.87 203,206,800 3 1.01

Branch Banking & Trust 97,101,769 7 0.44 - -

Herbalife International of America Inc 93,488,475 8 0.43 - -

Lowes Data Center 92,557,434 9 0.42 140,223,510 6 0.70

Wake Forest University 70,020,809 10 0.32 153,049,560 5 0.76

Highwoods/Forsyth Ltd. Partners - - 170,715,500 4 0.85

Dell Products LP - - 124,069,010 7 0.62

Hanesbrands Inc - - 119,773,670 8 0.60

Wal-Mart Real State Business Trust - - 76,605,860 9 0.38

Wells One West Fourth LLC - - 75,765,240 10 0.38

Total $ 1,760,943,666 8.03% $ 1,973,606,850 9.83%

Note:

Above taxable assessed valuations are as of January 1, 2018 and 2009 respectively, and the associated tax levies

of $.5974 and $.490 were due in fiscal years ended June 30, 2018 and 2009 respectively.

Source:

Forsyth County Tax Department and 2009 City of Winston-Salem CAFR.

205