Page 209 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 209

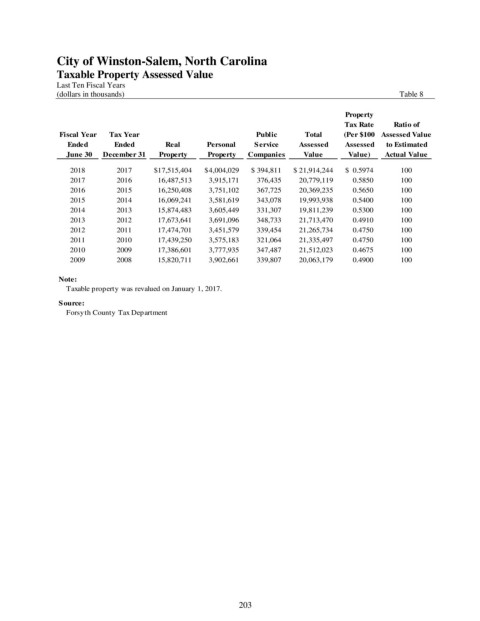

City of Winston-Salem, North Carolina

Taxable Property Assessed Value

Last Ten Fiscal Years

(dollars in thousands) Table 8

Property

Tax Rate Ratio of

Fiscal Year Tax Year Public Total (Per $100 Assessed Value

Ended Ended Real Personal Service Assessed Assessed to Estimated

June 30 December 31 Property Property Companies Value Value) Actual Value

2018 2017 $ 17,515,404 $ 4,004,029 $ 394,811 $ 21,914,244 $ 0.5974 100

2017 2016 16,487,513 3,915,171 376,435 20,779,119 0.5850 100

2016 2015 16,250,408 3,751,102 367,725 20,369,235 0.5650 100

2015 2014 16,069,241 3,581,619 343,078 19,993,938 0.5400 100

2014 2013 15,874,483 3,605,449 331,307 19,811,239 0.5300 100

2013 2012 17,673,641 3,691,096 348,733 21,713,470 0.4910 100

2012 2011 17,474,701 3,451,579 339,454 21,265,734 0.4750 100

2011 2010 17,439,250 3,575,183 321,064 21,335,497 0.4750 100

2010 2009 17,386,601 3,777,935 347,487 21,512,023 0.4675 100

2009 2008 15,820,711 3,902,661 339,807 20,063,179 0.4900 100

Note:

Taxable property was revalued on January 1, 2017.

Source:

Forsyth County Tax Department

203