Page 213 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 213

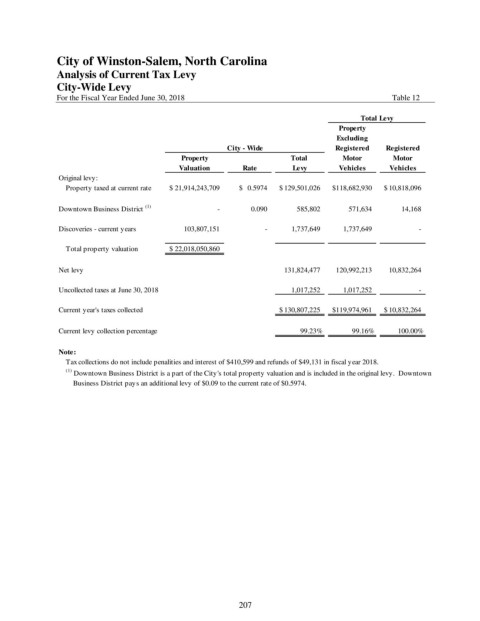

City of Winston-Salem, North Carolina

Analysis of Current Tax Levy

City-Wide Levy

For the Fiscal Year Ended June 30, 2018 Table 12

Total Levy

Property

Excluding

City - Wide Registered Registered

Property Total Motor Motor

Valuation Rate Levy Vehicles Vehicles

Original levy:

Property taxed at current rate $ 21,914,243,709 $ 0.5974 $ 129,501,026 $ 118,682,930 $ 10,818,096

Downtown Business District (1) - 0.090 585,802 571,634 14,168

Discoveries - current years 103,807,151 - 1,737,649 1,737,649 -

Total property valuation $ 22,018,050,860

Net levy 131,824,477 120,992,213 10,832,264

Uncollected taxes at June 30, 2018 1,017,252 1,017,252 -

Current year's taxes collected $ 130,807,225 $ 119,974,961 $ 10,832,264

Current levy collection percentage 99.23% 99.16% 100.00%

Note:

Tax collections do not include penalities and interest of $410,599 and refunds of $49,131 in fiscal year 2018.

(1)

Downtown Business District is a part of the City's total property valuation and is included in the original levy. Downtown

Business District pays an additional levy of $0.09 to the current rate of $0.5974.

207