Page 210 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 210

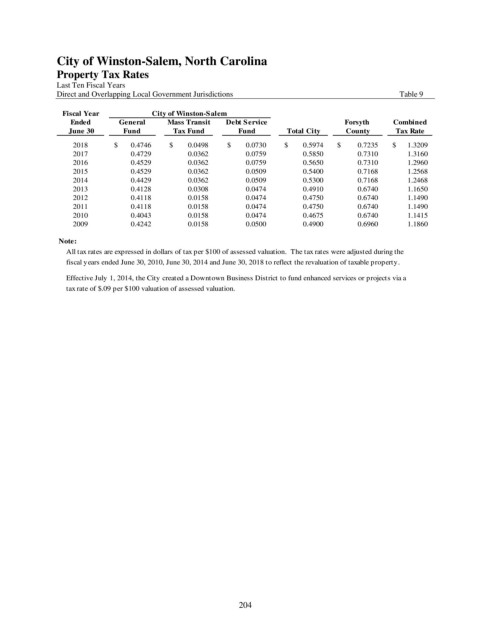

City of Winston-Salem, North Carolina

Property Tax Rates

Last Ten Fiscal Years

Direct and Overlapping Local Government Jurisdictions Table 9

Fiscal Year City of Winston-Salem

Ended General Mass Transit Debt Service Forsyth Combined

June 30 Fund Tax Fund Fund Total City County Tax Rate

2018 $ 0.4746 $ 0.0498 $ 0.0730 $ 0.5974 $ 0.7235 $ 1.3209

2017 0.4729 0.0362 0.0759 0.5850 0.7310 1.3160

2016 0.4529 0.0362 0.0759 0.5650 0.7310 1.2960

2015 0.4529 0.0362 0.0509 0.5400 0.7168 1.2568

2014 0.4429 0.0362 0.0509 0.5300 0.7168 1.2468

2013 0.4128 0.0308 0.0474 0.4910 0.6740 1.1650

2012 0.4118 0.0158 0.0474 0.4750 0.6740 1.1490

2011 0.4118 0.0158 0.0474 0.4750 0.6740 1.1490

2010 0.4043 0.0158 0.0474 0.4675 0.6740 1.1415

2009 0.4242 0.0158 0.0500 0.4900 0.6960 1.1860

Note:

All tax rates are expressed in dollars of tax per $100 of assessed valuation. The tax rates were adjusted during the

fiscal years ended June 30, 2010, June 30, 2014 and June 30, 2018 to reflect the revaluation of taxable property.

Effective July 1, 2014, the City created a Downtown Business District to fund enhanced services or projects via a

tax rate of $.09 per $100 valuation of assessed valuation.

204