Page 48 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 48

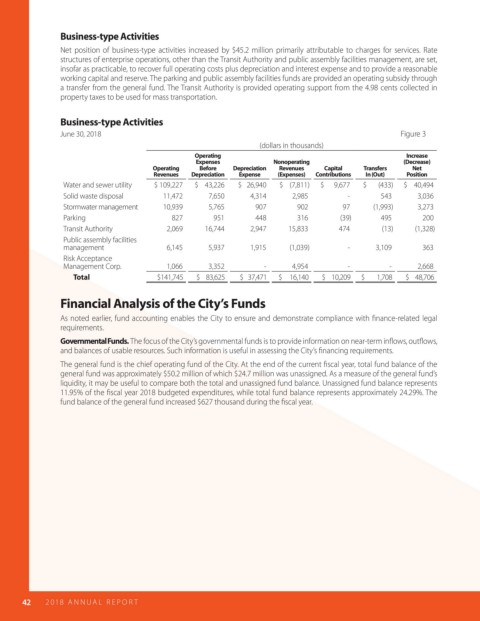

Business-type Activities

Net position of business-type activities increased by $45.2 million primarily attributable to charges for services. Rate

structures of enterprise operations, other than the Transit Authority and public assembly facilities management, are set,

insofar as practicable, to recover full operating costs plus depreciation and interest expense and to provide a reasonable

working capital and reserve. The parking and public assembly facilities funds are provided an operating subsidy through

a transfer from the general fund. The Transit Authority is provided operating support from the 4.98 cents collected in

property taxes to be used for mass transportation.

Business-type Activities

June 30, 2018 Figure 3

(dollars in thousands)

Operating Increase

Expenses Nonoperating (Decrease)

Operating Before Depreciation Revenues Capital Transfers Net

Revenues Depreciation Expense (Expenses) Contributions In (Out) Position

Water and sewer utility $ 109,227 $ 43,226 $ 26,940 $ (7,811) $ 9,677 $ (433) $ 40,494

Solid waste disposal 11,472 7,650 4,314 2,985 - 543 3,036

Stormwater management 10,939 5,765 907 902 97 (1,993) 3,273

Parking 827 951 448 316 (39) 495 200

Transit Authority 2,069 16,744 2,947 15,833 474 (13) (1,328)

Public assembly facilities

management 6,145 5,937 1,915 (1,039) - 3,109 363

Risk Acceptance

Management Corp. 1,066 3,352 - 4,954 - - 2,668

Total $141,745 $ 83,625 $ 37,471 $ 16,140 $ 10,209 $ 1,708 $ 48,706

Financial Analysis of the City’s Funds

As noted earlier, fund accounting enables the City to ensure and demonstrate compliance with nance-related legal

requirements.

Governmental Funds. The focus of the City’s governmental funds is to provide information on near-term in ows, out ows,

and balances of usable resources. Such information is useful in assessing the City’s nancing requirements.

The general fund is the chief operating fund of the City. At the end of the current scal year, total fund balance of the

general fund was approximately $50.2 million of which $24.7 million was unassigned. As a measure of the general fund’s

liquidity, it may be useful to compare both the total and unassigned fund balance. Unassigned fund balance represents

11.95% of the scal year 2018 budgeted expenditures, while total fund balance represents approximately 24.29%. The

fund balance of the general fund increased $627 thousand during the scal year.

42 2018 AN NUAL R E P O R T