Page 51 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 51

Major capital asset transactions during the year include the following:

• Construction in progress for governmental activities was $143.9 million, which re ects construction of street widening and resurfacing

projects, improvements to recreation centers and parks, improvements to re stations, and other economic development projects.

• Business-type capital assets increased $28 million which included major improvements to the extension of water and sewer lines,

Muddy Creek combined lift station, South Fork critical improvements, Muddy Creek combined heat and power, collection system

improvement program, outfall rehab projects, R. W. Neilson modernization project, and $2.5 million in stormwater capital projects.

Additional information on the City’s capital assets is included in Note 3D of the Basic Financial Statements.

Long-term Debt. The City utilizes various techniques to fund capital improvements and other long-term needs. A debt management

model is maintained which identi es resources available for current and future payments of principal and interest on outstanding

debt. Resources are identi ed and designated for payment of both principal and interest before issuance of additional debt. The

debt management model clearly identi es the City’s capacity for future debt service and the adequacy of designated resources.

In accordance with the Capital Improvement Program, funding for projects may include: current revenues or nancing by non-

voted general obligation bonds; general obligation bonds authorized by referendum; leasing through North Carolina Municipal

Leasing Corporation; installment nancing contracts; special obligation bonds; and revenue bonds for water and sewer utilities

and stormwater management.

At June 30, 2018, the City had total bonded debt outstanding of $634 million, of which, $174.5 million is backed by the City’s full

faith and credit and taxing power of the City and $459.5 million in bonds secured solely by speci ed revenue sources. Revenues

of the water and sewer utility system and stormwater management system are pledged as security for revenue bonds and special

obligation bonds are secured by the City’s sales tax revenue.

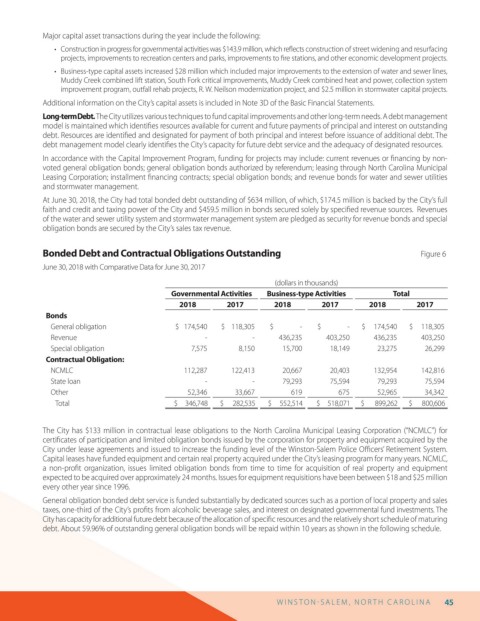

Bonded Debt and Contractual Obligations Outstanding Figure 6

June 30, 2018 with Comparative Data for June 30, 2017

(dollars in thousands)

Governmental Activities Business-type Activities Total

2018 2017 2018 2017 2018 2017

Bonds

General obligation $ 174,540 $ 118,305 $ - $ - $ 174,540 $ 118,305

Revenue - - 436,235 403,250 436,235 403,250

Special obligation 7,575 8,150 15,700 18,149 23,275 26,299

Contractual Obligation:

NCMLC 112,287 122,413 20,667 20,403 132,954 142,816

State loan - - 79,293 75,594 79,293 75,594

Other 52,346 33,667 619 675 52,965 34,342

Total $ 346,748 $ 282,535 $ 552,514 $ 518,071 $ 899,262 $ 800,606

The City has $133 million in contractual lease obligations to the North Carolina Municipal Leasing Corporation (“NCMLC”) for

certi cates of participation and limited obligation bonds issued by the corporation for property and equipment acquired by the

City under lease agreements and issued to increase the funding level of the Winston-Salem Police O cers’ Retirement System.

Capital leases have funded equipment and certain real property acquired under the City’s leasing program for many years. NCMLC,

a non-pro t organization, issues limited obligation bonds from time to time for acquisition of real property and equipment

expected to be acquired over approximately 24 months. Issues for equipment requisitions have been between $18 and $25 million

every other year since 1996.

General obligation bonded debt service is funded substantially by dedicated sources such as a portion of local property and sales

taxes, one-third of the City’s pro ts from alcoholic beverage sales, and interest on designated governmental fund investments. The

City has capacity for additional future debt because of the allocation of speci c resources and the relatively short schedule of maturing

debt. About 59.96% of outstanding general obligation bonds will be repaid within 10 years as shown in the following schedule.

W I N S T O N S AL E M , N O R T H C AR O L I N A 45