Page 84 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 84

The City has special authority to invest retirement, other employee bene ts, risk reserve, cemetery perpetual care funds,

and capital reserves designated by the City Council in “Securities and other investments authorized by State Law for the

State Treasurer” in N.C.G.S. §147-69.1 and N.C.G.S. §147-69.2. These investments have similar interest rate and credit risk

characteristics, include common stocks, municipal bonds and corporate bonds, and other instruments similar to those

used by the North Carolina State Treasurer for long-term nancial assets.

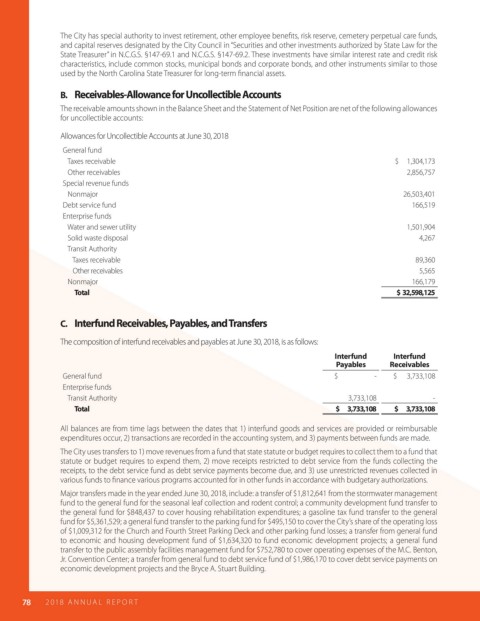

B. Receivables-Allowance for Uncollectible Accounts

The receivable amounts shown in the Balance Sheet and the Statement of Net Position are net of the following allowances

for uncollectible accounts:

Allowances for Uncollectible Accounts at June 30, 2018

General fund

Taxes receivable $ 1,304,173

Other receivables 2,856,757

Special revenue funds

Nonmajor 26,503,401

Debt service fund 166,519

Enterprise funds

Water and sewer utility 1,501,904

Solid waste disposal 4,267

Transit Authority

Taxes receivable 89,360

Other receivables 5,565

Nonmajor 166,179

Total $ 32,598,125

C. Interfund Receivables, Payables, and Transfers

The composition of interfund receivables and payables at June 30, 2018, is as follows:

Interfund Interfund

Payables Receivables

General fund $ - $ 3,733,108

Enterprise funds

Transit Authority 3,733,108 -

Total $ 3,733,108 $ 3,733,108

All balances are from time lags between the dates that 1) interfund goods and services are provided or reimbursable

expenditures occur, 2) transactions are recorded in the accounting system, and 3) payments between funds are made.

The City uses transfers to 1) move revenues from a fund that state statute or budget requires to collect them to a fund that

statute or budget requires to expend them, 2) move receipts restricted to debt service from the funds collecting the

receipts, to the debt service fund as debt service payments become due, and 3) use unrestricted revenues collected in

various funds to nance various programs accounted for in other funds in accordance with budgetary authorizations.

Major transfers made in the year ended June 30, 2018, include: a transfer of $1,812,641 from the stormwater management

fund to the general fund for the seasonal leaf collection and rodent control; a community development fund transfer to

the general fund for $848,437 to cover housing rehabilitation expenditures; a gasoline tax fund transfer to the general

fund for $5,361,529; a general fund transfer to the parking fund for $495,150 to cover the City’s share of the operating loss

of $1,009,312 for the Church and Fourth Street Parking Deck and other parking fund losses; a transfer from general fund

to economic and housing development fund of $1,634,320 to fund economic development projects; a general fund

transfer to the public assembly facilities management fund for $752,780 to cover operating expenses of the M.C. Benton,

Jr. Convention Center; a transfer from general fund to debt service fund of $1,986,170 to cover debt service payments on

economic development projects and the Bryce A. Stuart Building.

78 2018 AN NUAL R E P O R T