Page 86 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 86

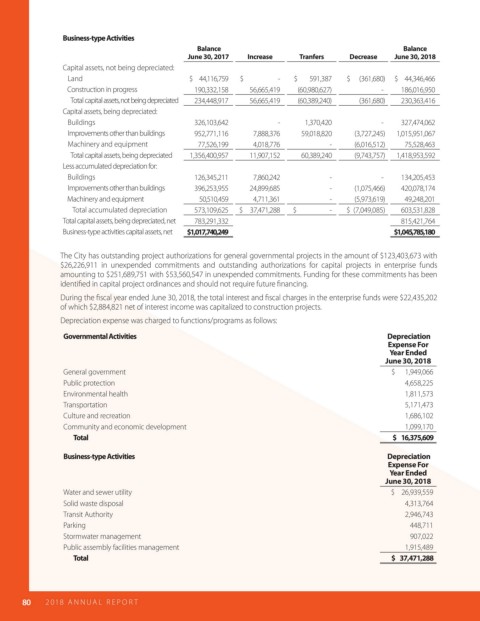

Business-type Activities

Balance Balance

June 30, 2017 Increase Tranfers Decrease June 30, 2018

Capital assets, not being depreciated:

Land $ 44,116,759 $ - $ 591,387 $ (361,680) $ 44,346,466

Construction in progress 190,332,158 56,665,419 (60,980,627) - 186,016,950

Total capital assets, not being depreciated 234,448,917 56,665,419 (60,389,240) (361,680) 230,363,416

Capital assets, being depreciated:

Buildings 326,103,642 - 1,370,420 - 327,474,062

Improvements other than buildings 952,771,116 7,888,376 59,018,820 (3,727,245) 1,015,951,067

Machinery and equipment 77,526,199 4,018,776 - (6,016,512) 75,528,463

Total capital assets, being depreciated 1,356,400,957 11,907,152 60,389,240 (9,743,757) 1,418,953,592

Less accumulated depreciation for:

Buildings 126,345,211 7,860,242 - - 134,205,453

Improvements other than buildings 396,253,955 24,899,685 - (1,075,466) 420,078,174

Machinery and equipment 50,510,459 4,711,361 - (5,973,619) 49,248,201

Total accumulated depreciation 573,109,625 $ 37,471,288 $ - $ (7,049,085) 603,531,828

Total capital assets, being depreciated, net 783,291,332 815,421,764

Business-type activities capital assets, net $1,017,740,249 $1,045,785,180

The City has outstanding project authorizations for general governmental projects in the amount of $123,403,673 with

$26,226,911 in unexpended commitments and outstanding authorizations for capital projects in enterprise funds

amounting to $251,689,751 with $53,560,547 in unexpended commitments. Funding for these commitments has been

identi ed in capital project ordinances and should not require future nancing.

During the scal year ended June 30, 2018, the total interest and scal charges in the enterprise funds were $22,435,202

of which $2,884,821 net of interest income was capitalized to construction projects.

Depreciation expense was charged to functions/programs as follows:

Governmental Activities Depreciation

Expense For

Year Ended

June 30, 2018

General government $ 1,949,066

Public protection 4,658,225

Environmental health 1,811,573

Transportation 5,171,473

Culture and recreation 1,686,102

Community and economic development 1,099,170

Total $ 16,375,609

Business-type Activities Depreciation

Expense For

Year Ended

June 30, 2018

Water and sewer utility $ 26,939,559

Solid waste disposal 4,313,764

Transit Authority 2,946,743

Parking 448,711

Stormwater management 907,022

Public assembly facilities management 1,915,489

Total $ 37,471,288

80 2018 AN NUAL R E P O R T