Page 88 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 88

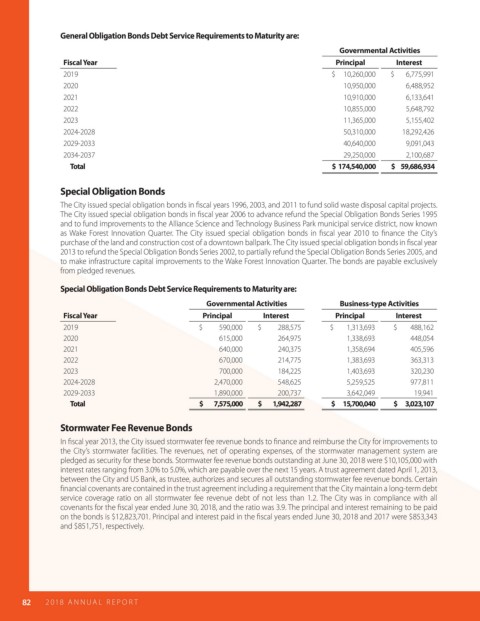

General Obligation Bonds Debt Service Requirements to Maturity are:

Governmental Activities

Fiscal Year Principal Interest

2019 $ 10,260,000 $ 6,775,991

2020 10,950,000 6,488,952

2021 10,910,000 6,133,641

2022 10,855,000 5,648,792

2023 11,365,000 5,155,402

2024-2028 50,310,000 18,292,426

2029-2033 40,640,000 9,091,043

2034-2037 29,250,000 2,100,687

Total $ 174,540,000 $ 59,686,934

Special Obligation Bonds

The City issued special obligation bonds in scal years 1996, 2003, and 2011 to fund solid waste disposal capital projects.

The City issued special obligation bonds in scal year 2006 to advance refund the Special Obligation Bonds Series 1995

and to fund improvements to the Alliance Science and Technology Business Park municipal service district, now known

as Wake Forest Innovation Quarter. The City issued special obligation bonds in scal year 2010 to nance the City’s

purchase of the land and construction cost of a downtown ballpark. The City issued special obligation bonds in scal year

2013 to refund the Special Obligation Bonds Series 2002, to partially refund the Special Obligation Bonds Series 2005, and

to make infrastructure capital improvements to the Wake Forest Innovation Quarter. The bonds are payable exclusively

from pledged revenues.

Special Obligation Bonds Debt Service Requirements to Maturity are:

Governmental Activities Business-type Activities

Fiscal Year Principal Interest Principal Interest

2019 $ 590,000 $ 288,575 $ 1,313,693 $ 488,162

2020 615,000 264,975 1,338,693 448,054

2021 640,000 240,375 1,358,694 405,596

2022 670,000 214,775 1,383,693 363,313

2023 700,000 184,225 1,403,693 320,230

2024-2028 2,470,000 548,625 5,259,525 977,811

2029-2033 1,890,000 200,737 3,642,049 19,941

Total $ 7,575,000 $ 1,942,287 $ 15,700,040 $ 3,023,107

Stormwater Fee Revenue Bonds

In scal year 2013, the City issued stormwater fee revenue bonds to nance and reimburse the City for improvements to

the City’s stormwater facilities. The revenues, net of operating expenses, of the stormwater management system are

pledged as security for these bonds. Stormwater fee revenue bonds outstanding at June 30, 2018 were $10,105,000 with

interest rates ranging from 3.0% to 5.0%, which are payable over the next 15 years. A trust agreement dated April 1, 2013,

between the City and US Bank, as trustee, authorizes and secures all outstanding stormwater fee revenue bonds. Certain

nancial covenants are contained in the trust agreement including a requirement that the City maintain a long-term debt

service coverage ratio on all stormwater fee revenue debt of not less than 1.2. The City was in compliance with all

covenants for the scal year ended June 30, 2018, and the ratio was 3.9. The principal and interest remaining to be paid

on the bonds is $12,823,701. Principal and interest paid in the scal years ended June 30, 2018 and 2017 were $853,343

and $851,751, respectively.

82 2018 AN NUAL R E P O R T