Page 90 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 90

Interest Rate Swap

Variable Rate Water and Sewer System Revenue Refunding Bonds, Series 2015A-1, Series 2015B-1 and Series 2015C-1

The City entered into an interest rate swap agreement (the “swap agreement”) with Citigroup, Inc. on November 12, 2002,

which became e ective on December 4, 2002, with the issuance of $37,090,000 Water and Sewer System Revenue Bonds,

Series 2002B (the “Series B Bonds”). In August 2015, the City issued variable rate water and sewer system revenue refunding

bonds. The net proceeds were used to refund the Water and Sewer Revenue Bonds, Series 2002B. At the same time, the

interest rate swap agreement was amended and restated. The 2015 interest rate swap transaction was structured to

establish a swap oating rate equal in all material respects to the oating rate for the Series 2015 Bonds. The underlying

variable index for each of the Series 2015 Bonds and 2015 Swaps is 69% of one-month LIBOR. Therefore, when taken

together, the oating rate on the Series 2015 Bonds, the oating rate on the 2015 Swaps and the xed rates on the 2015

Swaps will produce a “synthetic” xed rate. The synthetic xed rate for the Series 2015 A-1, 2015 B-1 and 2015 C-1 is 3.64%.

Under the swap agreement e ective August 19, 2015, beginning on the rst Wednesday in September 2015, and

continuing on a monthly basis, the City pays Citigroup, Inc. interest at the xed rate of 3.64% on the notional amount of

the Series 2015A-1, B-1, and C-1 Bonds. On or after August 19, 2015, Citigroup, Inc. pays the City an alternative oating rate

of 69% of the USD-LIBOR-BBA. The notional amount of the swap reduces annually; the reductions begin on June 6, 2019,

and end on the termination date of June 30, 2030.

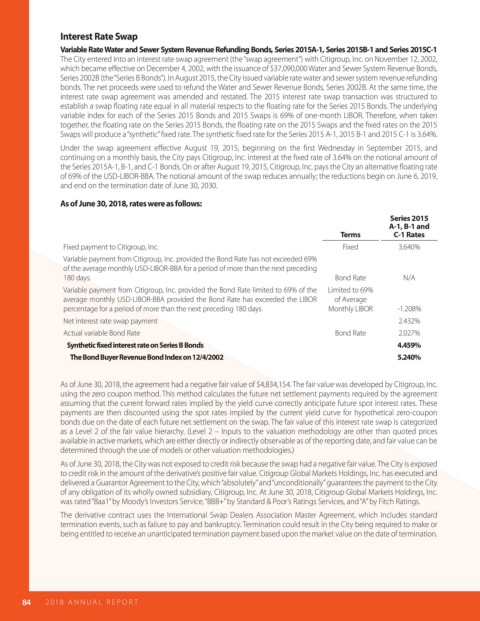

As of June 30, 2018, rates were as follows:

Series 2015

A-1, B-1 and

Terms C-1 Rates

Fixed payment to Citigroup, Inc. Fixed 3.640%

Variable payment from Citigroup, Inc. provided the Bond Rate has not exceeded 69%

of the average monthly USD-LIBOR-BBA for a period of more than the next preceding

180 days. Bond Rate N/A

Variable payment from Citigroup, Inc. provided the Bond Rate limited to 69% of the Limited to 69%

average monthly USD-LIBOR-BBA provided the Bond Rate has exceeded the LIBOR of Average

percentage for a period of more than the next preceding 180 days. Monthly LIBOR -1.208%

Net interest rate swap payment 2.432%

Actual variable Bond Rate Bond Rate 2.027%

Synthetic fixed interest rate on Series B Bonds 4.459%

The Bond Buyer Revenue Bond Index on 12/4/2002 5.240%

As of June 30, 2018, the agreement had a negative fair value of $4,834,154. The fair value was developed by Citigroup, Inc.

using the zero coupon method. This method calculates the future net settlement payments required by the agreement

assuming that the current forward rates implied by the yield curve correctly anticipate future spot interest rates. These

payments are then discounted using the spot rates implied by the current yield curve for hypothetical zero-coupon

bonds due on the date of each future net settlement on the swap. The fair value of this interest rate swap is categorized

as a Level 2 of the fair value hierarchy. (Level 2 – Inputs to the valuation methodology are other than quoted prices

available in active markets, which are either directly or indirectly observable as of the reporting date, and fair value can be

determined through the use of models or other valuation methodologies.)

As of June 30, 2018, the City was not exposed to credit risk because the swap had a negative fair value. The City is exposed

to credit risk in the amount of the derivative’s positive fair value. Citigroup Global Markets Holdings, Inc. has executed and

delivered a Guarantor Agreement to the City, which “absolutely” and “unconditionally” guarantees the payment to the City

of any obligation of its wholly owned subsidiary, Citigroup, Inc. At June 30, 2018, Citigroup Global Markets Holdings, Inc.

was rated “Baa1” by Moody’s Investors Service, “BBB+” by Standard & Poor’s Ratings Services, and “A” by Fitch Ratings.

The derivative contract uses the International Swap Dealers Association Master Agreement, which includes standard

termination events, such as failure to pay and bankruptcy. Termination could result in the City being required to make or

being entitled to receive an unanticipated termination payment based upon the market value on the date of termination.

84 2018 AN NUAL R E P O R T