Page 102 - 2018 Comprehensive Annual Financial Report - City of Winston-Salem

P. 102

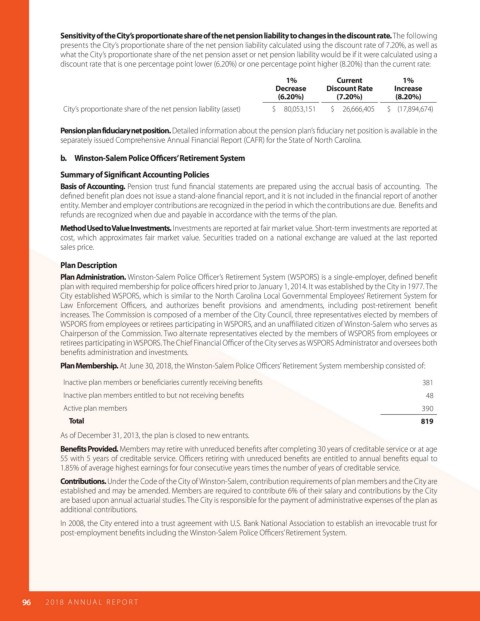

Sensitivity of the City’s proportionate share of the net pension liability to changes in the discount rate. The following

presents the City’s proportionate share of the net pension liability calculated using the discount rate of 7.20%, as well as

what the City’s proportionate share of the net pension asset or net pension liability would be if it were calculated using a

discount rate that is one percentage point lower (6.20%) or one percentage point higher (8.20%) than the current rate:

1% Current 1%

Decrease Discount Rate Increase

(6.20%) (7.20%) (8.20%)

City’s proportionate share of the net pension liability (asset) $ 80,053,151 $ 26,666,405 $ (17,894,674)

Pension plan fiduciary net position. Detailed information about the pension plan’s duciary net position is available in the

separately issued Comprehensive Annual Financial Report (CAFR) for the State of North Carolina.

b. Winston-Salem Police O cers’ Retirement System

Summary of Signi cant Accounting Policies

Basis of Accounting. Pension trust fund nancial statements are prepared using the accrual basis of accounting. The

de ned bene t plan does not issue a stand-alone nancial report, and it is not included in the nancial report of another

entity. Member and employer contributions are recognized in the period in which the contributions are due. Bene ts and

refunds are recognized when due and payable in accordance with the terms of the plan.

Method Used to Value Investments. Investments are reported at fair market value. Short-term investments are reported at

cost, which approximates fair market value. Securities traded on a national exchange are valued at the last reported

sales price.

Plan Description

Plan Administration. Winston-Salem Police O cer’s Retirement System (WSPORS) is a single-employer, de ned bene t

plan with required membership for police o cers hired prior to January 1, 2014. It was established by the City in 1977. The

City established WSPORS, which is similar to the North Carolina Local Governmental Employees’ Retirement System for

Law Enforcement O cers, and authorizes bene t provisions and amendments, including post-retirement bene t

increases. The Commission is composed of a member of the City Council, three representatives elected by members of

WSPORS from employees or retirees participating in WSPORS, and an una liated citizen of Winston-Salem who serves as

Chairperson of the Commission. Two alternate representatives elected by the members of WSPORS from employees or

retirees participating in WSPORS. The Chief Financial O cer of the City serves as WSPORS Administrator and oversees both

bene ts administration and investments.

Plan Membership. At June 30, 2018, the Winston-Salem Police O cers’ Retirement System membership consisted of:

Inactive plan members or bene ciaries currently receiving bene ts 381

Inactive plan members entitled to but not receiving bene ts 48

Active plan members 390

Total 819

As of December 31, 2013, the plan is closed to new entrants.

Benefits Provided. Members may retire with unreduced bene ts after completing 30 years of creditable service or at age

55 with 5 years of creditable service. O cers retiring with unreduced bene ts are entitled to annual bene ts equal to

1.85% of average highest earnings for four consecutive years times the number of years of creditable service.

Contributions. Under the Code of the City of Winston-Salem, contribution requirements of plan members and the City are

established and may be amended. Members are required to contribute 6% of their salary and contributions by the City

are based upon annual actuarial studies. The City is responsible for the payment of administrative expenses of the plan as

additional contributions.

In 2008, the City entered into a trust agreement with U.S. Bank National Association to establish an irrevocable trust for

post-employment bene ts including the Winston-Salem Police O cers’ Retirement System.

96 2018 AN NUAL R E P O R T