Page 231 - CRC_One Report 2021_EN

P. 231

Business Overview and Performance Corporate Governance Financial Statements Enclosure

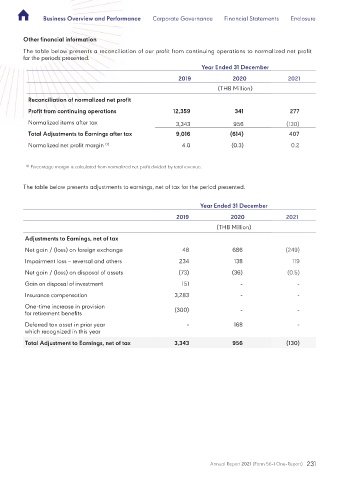

Other financial information

The table below presents a reconciliation of our profit from continuing operations to normalized net profit

for the periods presented.

Year Ended 31 December

2019 2020 2021

(THB Million)

Reconciliation of normalized net profit

Profit from continuing operations 12,359 341 277

Normalized items after tax 3,343 956 (130)

Total Adjustments to Earnings after tax 9,016 (614) 407

Normalized net profit margin (1) 4.0 (0.3) 0.2

(1) Percentage margin is calculated from normalized net profit divided by total revenue.

The table below presents adjustments to earnings, net of tax for the period presented.

Year Ended 31 December

2019 2020 2021

(THB Million)

Adjustments to Earnings, net of tax

Net gain / (loss) on foreign exchange 48 686 (249)

Impairment loss – reversal and others 234 138 119

Net gain / (loss) on disposal of assets (73) (36) (0.5)

Gain on disposal of investment 151 - -

Insurance compensation 3,283 - -

One-time increase in provision

(300) - -

for retirement benefits

Deferred tax asset in prior year - 168 -

which recognized in this year

Total Adjustment to Earnings, net of tax 3,343 956 (130)

Annual Report 2021 (Form 56-1 One-Report) 231