Page 233 - CRC_One Report 2021_EN

P. 233

Business Overview and Performance Corporate Governance Financial Statements Enclosure

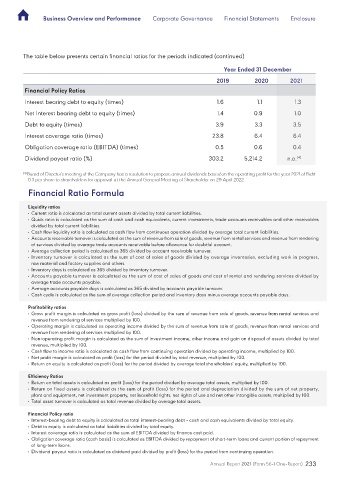

The table below presents certain financial ratios for the periods indicated (continued)

Year Ended 31 December

2019 2020 2021

Financial Policy Ratios

Interest bearing debt to equity (times) 1.6 1.1 1.3

Net Interest bearing debt to equity (times) 1.4 0.9 1.0

Debt to equity (times) 3.9 3.3 3.5

Interest coverage ratio (times) 23.8 6.4 6.4

Obligation coverage ratio (EBITDA) (times) 0.5 0.6 0.4

Dividend payout ratio (%) 303.2 5,214.2 n.a. (4)

(4) Board of Director’s meeting of the Company has a resolution to propose annual dividends based on the operating profit for the year 2021 of Baht

0.3 per share to shareholders for approval at the Annual General Meeting of Shareholder on 29 April 2022.

Financial Ratio Formula

Liquidity ratios

• Current ratio is calculated as total current assets divided by total current liabilities.

• Quick ratio is calculated as the sum of cash and cash equivalents, current investments, trade accounts receivables and other receivables

divided by total current liabilities.

• Cash flow liquidity ratio is calculated as cash flow from continuous operation divided by average total current liabilities.

• Accounts receivable turnover is calculated as the sum of revenue from sale of goods, revenue from rental services and revenue from rendering

of services divided by average trade accounts receivable before allowance for doubtful account.

• Average collection period is calculated as 365 divided by account receivable turnover.

• Inventory turnover is calculated as the sum of cost of sales of goods divided by average inventories, excluding work in progress,

raw material and factory supplies and others.

• Inventory days is calculated as 365 divided by inventory turnover.

• Accounts payable turnover is calculated as the sum of cost of sales of goods and cost of rental and rendering services divided by

average trade accounts payable.

• Average accounts payable days is calculated as 365 divided by accounts payable turnover.

• Cash cycle is calculated as the sum of average collection period and inventory days minus average accounts payable days.

Profitability ratios

• Gross profit margin is calculated as gross profit (loss) divided by the sum of revenue from sale of goods, revenue from rental services and

revenue from rendering of services multiplied by 100.

• Operating margin is calculated as operating income divided by the sum of revenue from sale of goods, revenue from rental services and

revenue from rendering of services multiplied by 100.

• Non-operating profit margin is calculated as the sum of investment income, other income and gain on disposal of assets divided by total

revenue, multiplied by 100.

• Cash flow to income ratio is calculated as cash flow from continuing operation divided by operating income, multiplied by 100.

• Net profit margin is calculated as profit (loss) for the period divided by total revenue, multiplied by 100.

• Return on equity is calculated as profit (loss) for the period divided by average total shareholders’ equity, multiplied by 100.

Efficiency Ratios

• Return on total assets is calculated as profit (loss) for the period divided by average total assets, multiplied by 100.

• Return on fixed assets is calculated as the sum of profit (loss) for the period and depreciation divided by the sum of net property,

plant and equipment, net investment property, net leasehold rights, net rights of use and net other intangible assets, multiplied by 100.

• Total asset turnover is calculated as total revenue divided by average total assets.

Financial Policy ratio

• Interest-bearing debt to equity is calculated as total interest-bearing debt - cash and cash equivalents divided by total equity.

• Debt to equity is calculated as total liabilities divided by total equity.

• Interest coverage ratio is calculated as the sum of EBITDA divided by finance cost paid.

• Obligation coverage ratio (cash basis) is calculated as EBITDA divided by repayment of short-term loans and current portion of repayment

of long-term loans.

• Dividend payout ratio is calculated as dividend paid divided by profit (loss) for the period from continuing operation.

Annual Report 2021 (Form 56-1 One-Report) 233