Page 470 - CRC_One Report 2021_EN

P. 470

Business Overview and Performance Corporate Governance Financial Statements Enclosure

Central Retail Corporation Public Company Limited and its Subsidiaries

Notes to the financial statements

For the year ended 31 December 2021

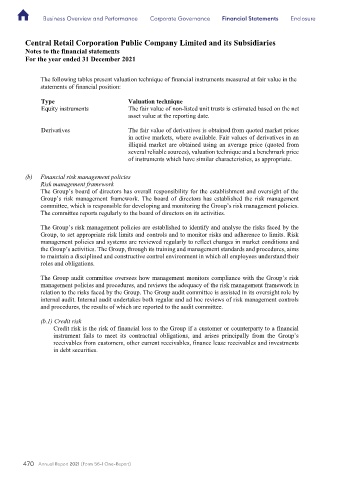

The following tables present valuation technique of financial instruments measured at fair value in the

statements of financial position:

Type Valuation technique

Equity instruments The fair value of non-listed unit trusts is estimated based on the net

asset value at the reporting date.

Derivatives The fair value of derivatives is obtained from quoted market prices

in active markets, where available. Fair values of derivatives in an

illiquid market are obtained using an average price (quoted from

several reliable sources), valuation technique and a benchmark price

of instruments which have similar characteristics, as appropriate.

(b) Financial risk management policies

Risk management framework

The Group’s board of directors has overall responsibility for the establishment and oversight of the

Group’s risk management framework. The board of directors has established the risk management

committee, which is responsible for developing and monitoring the Group’s risk management policies.

The committee reports regularly to the board of directors on its activities.

The Group’s risk management policies are established to identify and analyse the risks faced by the

Group, to set appropriate risk limits and controls and to monitor risks and adherence to limits. Risk

management policies and systems are reviewed regularly to reflect changes in market conditions and

the Group’s activities. The Group, through its training and management standards and procedures, aims

to maintain a disciplined and constructive control environment in which all employees understand their

roles and obligations.

The Group audit committee oversees how management monitors compliance with the Group’s risk

management policies and procedures, and reviews the adequacy of the risk management framework in

relation to the risks faced by the Group. The Group audit committee is assisted in its oversight role by

internal audit. Internal audit undertakes both regular and ad hoc reviews of risk management controls

and procedures, the results of which are reported to the audit committee.

(b.1) Credit risk

Credit risk is the risk of financial loss to the Group if a customer or counterparty to a financial

instrument fails to meet its contractual obligations, and arises principally from the Group’s

receivables from customers, other current receivables, finance lease receivables and investments

in debt securities.

470 Annual Report 2021 (Form 56-1 One-Report)

80