Page 474 - CRC_One Report 2021_EN

P. 474

Business Overview and Performance Corporate Governance Financial Statements Enclosure

Central Retail Corporation Public Company Limited and its Subsidiaries

Central Retail Corporation Public Company Limited and its Subsidiaries

Notes to the financial statements

Notes to the financial statements

For the year ended 31 December 2021

For the year ended 31 December 2021

All associates were incorporated and mainly operate in Thailand, except for COL Vietnam Joint Stock Company

which was incorporated and mainly operates in Vietnam.

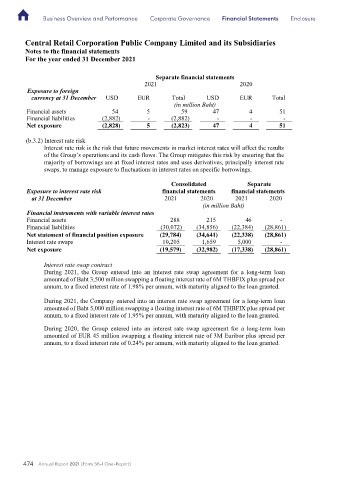

Separate financial statements

2021 2020

Exposure to foreign were incorporated and mainly operate in Thailand, except for Morningbliss SDN. BHD and

All joint ventures

currency at 31 December USD EUR Total USD EUR Total

Porto Worldwide Limited which were incorporated and mainly operates in Malaysia and Hong Kong, respectively.

(in million Baht)

Financial assets 54 pany’s associates and joint ventures are publicly listed and consequently they

4

59

47

5

51

None of the Group’s and the Com

Financial liabilities (2,882) - (2,882) - - -

do not have published price quotations.

Net exposure (2,828) 5 (2,823) 47 4 51

Consolidated

Material movem

(b.3.2) Interest rate risk ents financial statements

2020

for the year ended 31 December

2021

Interest rate risk is the risk that future movements in market interest rates will affect the results

of the Group’s operations and its cash flows. The Group mitigates this risk by ensuring that the

(in million Baht)

Joint ventures

majority of borrowings are at fixed interest rates and uses derivatives, principally interest rate

Acquisition share capital in Porto Worldwide Limited 4,452 -

swaps, to manage exposure to fluctuations in interest rates on specific borrowings.

Increase in share capital in MUJI Retail (Thailand) Co., Ltd. 70 20

Consolidated Separate

Investments in joint ventures

Exposure to interest rate risk financial statements financial statements

at 31 December 2021 2020 2021 2020

Acquisition (in million Baht)

Financial instruments with variable interest rates

In December 2021, the Group acquired 133,545,740 shares, equivalent to 67% of share capital of Porto

Financial assets 288 215 46 -

Worldwide Limited incorporated in Hong Kong for a consideration of Baht 4,452 million from a related

Financial liabilities (30,072) (34,856) (22,384) (28,861)

party, which became a joint venture between the Group and Central Pattana Public Company Limited

Net statement of financial position exposure (29,784) (34,641) (22,338) (28,861)

(CPN). The purpose of this joint venture is to invest 40% shareholding in Grabtaxi Holdings (Thailand)

Interest rate swaps 10,205 1,659 5,000 -

Co., Ltd. The acquisition is in accordance with the obligations stipulated in the SPA which was approved

Net exposure (19,579) (32,982) (17,338) (28,861)

by the Board of Directors’ meeting of the Company on 10 December 2019 and the Shareholders’

meeting of the Company on 19 December 2019. Additional, in the future, Porto Worldwide Limited has

Interest rate swap contract

the right to swap its shares, in part or entirety, in GrabTaxi Holdings (Thailand) Co., Ltd. with the Class

During 2021, the Group entered into an interest rate swap agreement for a long-term loan

A ordinary shares of Grab Holdings Limited which listed on the NASDAQ with the designated price

amounted of Baht 3,500 million swapping a floating interest rate of 6M THBFIX plus spread per

within the specified period.

annum, to a fixed interest rate of 1.98% per annum, with maturity aligned to the loan granted.

Increase in share capital

During 2021, the Company entered into an interest rate swap agreement for a long-term loan

amounted of Baht 5,000 million swapping a floating interest rate of 6M THBFIX plus spread per

During 2021, the Group made additional investments in MUJI Retail (Thailand) Co., Ltd. to increase

annum, to a fixed interest rate of 1.95% per annum, with maturity aligned to the loan granted.

share capital of 700,000 shares, amounting to Baht 70 million.

During 2020, the Group entered into an interest rate swap agreement for a long-term loan

During 2020, the Group made additional investments in MUJI Retail (Thailand) Co., Ltd. to increase

amounted of EUR 45 million swapping a floating interest rate of 3M Euribor plus spread per

share capital of 200,000 shares, amounting to Baht 20 million.

annum, to a fixed interest rate of 0.24% per annum, with maturity aligned to the loan granted.

474 Annual Report 2021 (Form 56-1 One-Report)

84 48