Page 475 - CRC_One Report 2021_EN

P. 475

Business Overview and Performance Corporate Governance Financial Statements Enclosure

Central Retail Corporation Public Company Limited and its Subsidiaries

Notes to the financial statements

For the year ended 31 December 2021

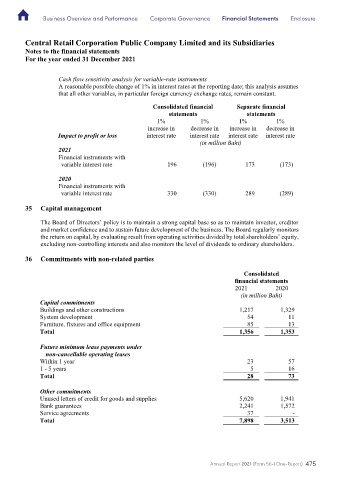

Cash flow sensitivity analysis for variable-rate instruments

A reasonable possible change of 1% in interest rates at the reporting date; this analysis assumes

that all other variables, in particular foreign currency exchange rates, remain constant.

Consolidated financial Separate financial

statements statements

1% 1% 1% 1%

increase in decrease in increase in decrease in

Impact to profit or loss interest rate interest rate interest rate interest rate

(in million Baht)

2021

Financial instruments with

variable interest rate 196 (196) 173 (173)

2020

Financial instruments with

variable interest rate 330 (330) 289 (289)

35 Capital management

The Board of Directors’ policy is to maintain a strong capital base so as to maintain investor, creditor

and market confidence and to sustain future development of the business. The Board regularly monitors

the return on capital, by evaluating result from operating activities divided by total shareholders’ equity,

excluding non-controlling interests and also monitors the level of dividends to ordinary shareholders.

36 Commitments with non-related parties

Consolidated

financial statements

2021 2020

(in million Baht)

Capital commitments

Buildings and other constructions 1,217 1,329

System development 54 11

Furniture, fixtures and office equipment 85 13

Total 1,356 1,353

Future minimum lease payments under

non-cancellable operating leases

Within 1 year 23 57

1 - 5 years 5 16

Total 28 73

Other commitments

Unused letters of credit for goods and supplies 5,620 1,941

Bank guarantees 2,241 1,572

Service agreements 37 -

Total 7,898 3,513

Annual Report 2021 (Form 56-1 One-Report) 475

85