Page 472 - CRC_One Report 2021_EN

P. 472

Business Overview and Performance Corporate Governance Financial Statements Enclosure

Central Retail Corporation Public Company Limited and its Subsidiaries

Central Retail Corporation Public Company Limited and its Subsidiaries

Notes to the financial statements

Notes to the financial statements

For the year ended 31 December 2021

For the year ended 31 December 2021

All associates were incorporated and mainly operate in Thailand, except for COL Vietnam Joint Stock Company

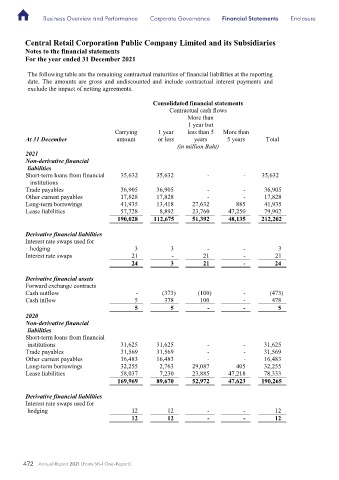

The following table are the remaining contractual maturities of financial liabilities at the reporting

which was incorporated and mainly operates in Vietnam.

date. The amounts are gross and undiscounted and include contractual interest payments and

exclude the impact of netting agreements.

All joint ventures were incorporated and mainly operate in Thailand, except for Morningbliss SDN. BHD and

Porto Worldwide Limited which were incorporated and mainly operates in Malaysia and Hong Kong, respectively.

Consolidated financial statements

None of the Group’s and the Company’s associates and joint ventures are publicly listed and consequently they

Contractual cash flows

do not have published price quotations. More than

1 year but

Consolidated

Carrying 1 year less than 5 More than

At 31 December amount or less years 5 years Total

Material movements

financial statements

for the year ended 31 December (in million Baht) 2021 2020

2021 (in million Baht)

Non-derivative financial

Joint ventures

liabilities 4,452 -

Acquisition share capital in Porto Worldwide Limited

Short-term loans from financial 35,632 35,632 - - 35,632

20

70

Increase in share capital in MUJI Retail (Thailand) Co., Ltd.

institutions

Trade payables 36,905 36,905 - - 36,905

Investments in joint ventures

Other current payables 17,828 17,828 - - 17,828

Long-term borrowings 41,935 13,418 27,632 885 41,935

Acquisition

Lease liabilities 57,728 8,892 23,7 60 47,250 79,902

48,135

190,028

51,392

In December 2021, the Group acquired 133,545,740 shares, equivalent to 67% of share capita l of Porto

212,202

112,675

Worldwide Limited incorporated in Hong Kong for a consideration of Baht 4,452 million from a related

party, which became a joint venture be

Derivative financial liabilities tween the Group and Central Pattana Public Company Limited

Interest rate swaps used for f this joint venture is to invest 40% shareholding in Grabtaxi Holdings (Thailand)

(CPN). The purpose o

Co., Ltd. The acquisition is in accordance with the obli

-

-

hedging 3 3 gations stipulated in the SPA which was approved

3

by the Board of Directors’ meeting

21

21

-

Interest rate swaps 21 of the Company on 10 December 2019 and the Shareholders’

-

-

3

24

24

meeting of the Company on 19 December 2019. Additional, in the future, Porto Worldwide Limited has

21

the right to swap its shares, in part or entirety, in GrabTaxi Holdings (Thailand) Co., Ltd. with the Class

A ordinary shares of Grab Holdings Limited which listed on the NASDAQ with the designated price

Derivative financial assets

within the specified period.

Forward exchange contracts

Cash outflow - (373) (100) - (473)

Increase in share capital

Cash inflow 5 378 100 - 478

5 5 - - 5

2020 During 2021, the Group made additional investments in MUJI Retail (Thailand) Co., Ltd. to increase

share capital of 700,000 shares, amounting to Baht 70 million.

Non-derivative financial

liabilities

During 2020, the Group made additional investments in MUJI Retail (Thailand) Co., Ltd. to increase

Short-term loans from financial

share capital of 200,000 shares, amounting to Baht 20 million.

institutions 31,625 31,625 - - 31,625

Trade payables 31,569 31,569 - - 31,569

Other current payables 16,483 16,483 - - 16,483

Long-term borrowings 32,255 2,763 29,087 405 32,255

Lease liabilities 58,037 7,230 23,885 47,218 78,333

169,969 89,670 52,972 47,623 190,265

Derivative financial liabilities

Interest rate swaps used for

hedging 12 12 - - 12

12 12 - - 12

472 Annual Report 2021 (Form 56-1 One-Report)

82

48