Page 19 - 2021 Team Member Benefit Guide - English

P. 19

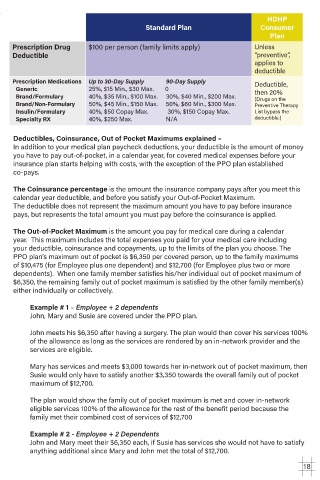

HDHP

Standard Plan Consumer

Plan

Prescription Drug $100 per person (family limits apply) Unless

Deductible “preventive”,

applies to

deductible

Prescription Medications Up to 30-Day Supply 90-Day Supply Deductible,

Generic 25%, $15 Min., $30 Max. 0 then 20%

Brand/Formulary 40%, $35 Min., $100 Max. 30%, $40 Min., $200 Max. (Drugs on the

Brand/Non-Formulary 50%, $45 Min., $150 Max. 50%, $60 Min., $300 Max. Preventive Therapy

Insulin/Formulary 40%, $50 Copay Max. 30%, $150 Copay Max. List bypass the

Specialty RX 40%, $250 Max. N/A deductible.)

Deductibles, Coinsurance, Out of Pocket Maximums explained –

In addition to your medical plan paycheck deductions, your deductible is the amount of money

you have to pay out-of-pocket, in a calendar year, for covered medical expenses before your

insurance plan starts helping with costs, with the exception of the PPO plan established

co-pays.

The Coinsurance percentage is the amount the insurance company pays after you meet this

calendar year deductible, and before you satisfy your Out-of-Pocket Maximum.

The deductible does not represent the maximum amount you have to pay before insurance

pays, but represents the total amount you must pay before the coinsurance is applied.

The Out-of-Pocket Maximum is the amount you pay for medical care during a calendar

year. This maximum includes the total expenses you paid for your medical care including

your deductible, coinsurance and copayments, up to the limits of the plan you choose. The

PPO plan’s maximum out of pocket is $6,350 per covered person, up to the family maximums

of $10,475 (for Employee plus one dependent) and $12,700 (for Employee plus two or more

dependents). When one family member satisfies his/her individual out of pocket maximum of

$6,350, the remaining family out of pocket maximum is satisfied by the other family member(s)

either individually or collectively.

Example # 1 – Employee + 2 dependents

John, Mary and Susie are covered under the PPO plan.

John meets his $6,350 after having a surgery. The plan would then cover his services 100%

of the allowance as long as the services are rendered by an in-network provider and the

services are eligible.

Mary has services and meets $3,000 towards her in-network out of pocket maximum, then

Susie would only have to satisfy another $3,350 towards the overall family out of pocket

maximum of $12,700.

The plan would show the family out of pocket maximum is met and cover in-network

eligible services 100% of the allowance for the rest of the benefit period because the

family met their combined cost of services of $12,700

Example # 2 - Employee + 2 Dependents

John and Mary meet their $6,350 each, if Susie has services she would not have to satisfy

anything additional since Mary and John met the total of $12,700.

18