Page 16 - 2021 Team Member Benefit Guide - English

P. 16

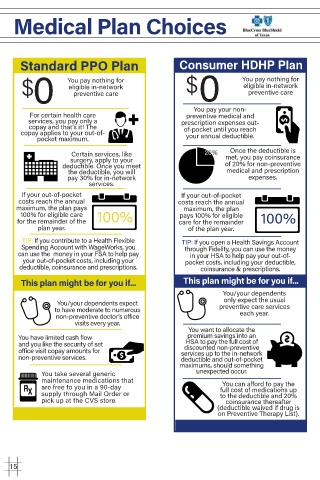

Medical Plan Choices

Standard PPO Plan Consumer HDHP Plan

$ 0 You pay nothing for $ 0 You pay nothing for

eligible in-network

eligible in-network

preventive care

preventive care

You pay your non-

For certain health care preventive medical and

services, you pay only a prescription expenses out-

copay and that’s it! The

copay applies to your out-of- of-pocket until you reach

your annual deductible.

pocket maximum.

2

0%

Certain services, like 20% Once the deductible is

surgery, apply to your met, you pay coinsurance

deductible. Once you meet of 20% for non-preventive

the deductible, you will medical and prescription

pay 30% for in-network expenses.

services.

If your out-of-pocket If your out-of-pocket

costs reach the annual costs reach the annual

maximum, the plan pays maximum, the plan

for the remainder of the 100% care for the remainder 100%

100% for eligible care

pays 100% for eligible

plan year. of the plan year.

TIP: If you contribute to a Health Flexible TIP: If you open a Health Savings Account

Spending Account with WageWorks, you through Fidelity, you can use the money

can use the money in your FSA to help pay in your HSA to help pay your out-of-

your out-of-pocket costs, including your pocket costs, including your deductible,

deductible, coinsurance and prescriptions. coinsurance & prescriptions.

This plan might be for you if... This plan might be for you if...

You/your dependents

You/your dependents expect only expect the usual

to have moderate to numerous preventive care services

non-preventive doctor’s office each year.

visits every year.

You want to allocate the

You have limited cash flow premium savings into an

HSA to pay the full cost of

and you like the security of set discounted non-preventive

office visit copay amounts for services up to the in-network

non-preventive services. deductible and out-of-pocket

maximums, should something

You take several generic unexpected occur.

maintenance medications that You can afford to pay the

are free to you in a 90-day full cost of medications up

supply through Mail Order or to the deductible and 20%

pick up at the CVS store. coinsurance thereafter

(deductible waived if drug is

on Preventive Therapy List).

15