Page 30 - Hybrid PBD 2022 Form 5 - Mathematics

P. 30

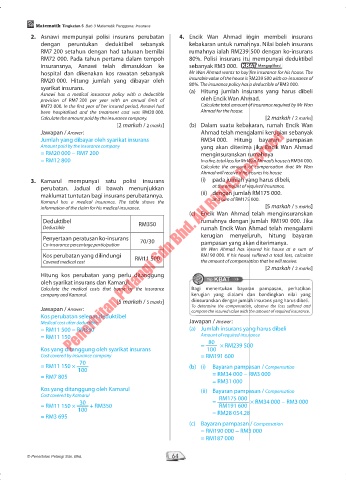

Matematik Tingkatan 5 Bab 3 Matematik Pengguna: Insurans

2. Asnawi mempunyai polisi insurans perubatan 4. Encik Wan Ahmad ingin membeli insurans

dengan peruntukan deduktibel sebanyak kebakaran untuk rumahnya. Nilai boleh insurans

RM7 200 setahun dengan had tahunan bernilai rumahnya ialah RM239 500 dengan ko-insurans

RM72 000. Pada tahun pertama dalam tempoh 80%. Polisi insurans itu mempunyai deduktibel

insuransnya, Asnawi telah dimasukkan ke sebanyak RM3 000. KBAT Mengaplikasi

hospital dan dikenakan kos rawatan sebanyak Mr Wan Ahmad wants to buy fire insurance for his house. The

RM20 000. Hitung jumlah yang dibayar oleh insurable value of the house is RM239 500 with co-insurance of

80%. The insurance policy has a deductible of RM3 000.

syarikat insurans.

Asnawi has a medical insurance policy with a deductible (a) Hitung jumlah insurans yang harus dibeli

provision of RM7 200 per year with an annual limit of oleh Encik Wan Ahmad.

RM72 000. In the first year of her insured period, Asnawi had Calculate total amount of insurance required by Mr Wan

been hospitalised and the treatment cost was RM20 000. Ahmad for the house.

Calculate the amount paid by the insurance company. [2 markah / 2 marks]

[2 markah / 2 marks] (b) Dalam suatu kebakaran, rumah Encik Wan

Penerbitan Pelangi Sdn Bhd. All Rights Reserved

Jawapan / Answer : Ahmad telah mengalami kerugian sebanyak

Jumlah yang dibayar oleh syarikat insurans RM34 000. Hitung bayaran pampasan

Amount paid by the insurance company yang akan diterima jika Encik Wan Ahmad

= RM20 000 − RM7 200 menginsuranskan rumahnya

= RM12 800 In a fire, total loss for Mr Wan Ahmad’s house is RM34 000.

Calculate the amount of compensation that Mr Wan

Ahmad will receive if he insures his house

3. Kamarul mempunyai satu polisi insurans (i) pada jumlah yang harus dibeli,

perubatan. Jadual di bawah menunjukkan at the amount of required insurance,

maklumat tuntutan bagi insurans perubatannya. (ii) dengan jumlah RM175 000.

Kamarul has a medical insurance. The table shows the at a sum of RM175 000.

information of the claim for his medical insurance. [5 markah / 5 marks]

(c) Encik Wan Ahmad telah menginsuranskan

Deduktibel RM350 rumahnya dengan jumlah RM190 000. Jika

Deductible rumah Encik Wan Ahmad telah mengalami

Penyertaan peratusan ko-insurans 70/30 kerugian menyeluruh, hitung bayaran

Co-insurance percentage participation pampasan yang akan diterimanya.

Mr Wan Ahmad has insured his house at a sum of

Kos perubatan yang dilindungi RM11 500 RM190 000. If his house suffered a total loss, calculate

Covered medical cost the amount of compensation that he will receive.

[2 markah / 2 marks]

Hitung kos perubatan yang perlu ditanggung Tip KBATKBAT

oleh syarikat insurans dan Kamarul. KBAT

Calculate the medical costs that borne by the insurance Bagi menentukan bayaran pampasan, perhatikan

company and Kamarul. kerugian yang dialami dan bandingkan nilai yang

[5 markah / 5 marks] diinsuranskan dengan jumlah insurans yang harus dibeli.

Jawapan / Answer : To determine the compensation, observe the loss suffered and

compare the insured value with the amount of required insurance.

Kos perubatan selepas deduktibel

Medical cost after deductible Jawapan / Answer :

= RM11 500 − RM350 (a) Jumlah insurans yang harus dibeli

= RM11 150 Amount of required insurance

= 80 × RM239 500

Kos yang ditanggung oleh syarikat insurans 100

Cost covered by insurance company = RM191 600

70

= RM11 150 × (b) (i) Bayaran pampasan / Compensation

100

= RM7 805 = RM34 000 − RM3 000

= RM31 000

Kos yang ditanggung oleh Kamarul (ii) Bayaran pampasan / Compensation

Cost covered by Kamarul RM175 000

30 = × RM34 000 − RM3 000

= RM11 150 × + RM350 RM191 600

100

= RM3 695 = RM28 054.28

(c) Bayaran pampasan / Compensation

= RM190 000 − RM3 000

= RM187 000

© Penerbitan Pelangi Sdn. Bhd. 64

03 Hybrid PBD Mate Tg5.indd 64 28/09/2021 5:08 PM