Page 46 - mutual-fund-insight - Mar 2021_Neat

P. 46

THE PLAN

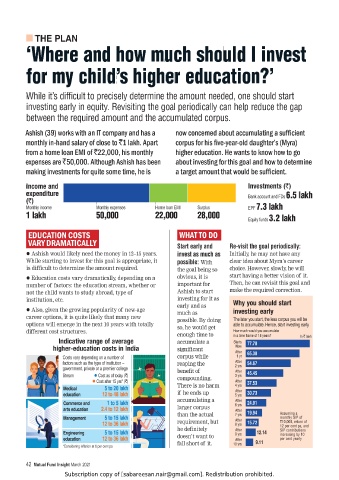

‘Where and how much should I invest

for my child’s higher education?’

While it’s difficult to precisely determine the amount needed, one should start

investing early in equity. Revisiting the goal periodically can help reduce the gap

between the required amount and the accumulated corpus.

Ashish (39) works with an IT company and has a now concerned about accumulating a sufficient

monthly in-hand salary of close to `1 lakh. Apart corpus for his five-year-old daughter’s (Myra)

from a home loan EMI of `22,000, his monthly higher education. He wants to know how to go

expenses are `50,000. Although Ashish has been about investing for this goal and how to determine

making investments for quite some time, he is a target amount that would be sufficient.

0UJVTL HUK 0U]LZ[TLU[Z `

L_WLUKP[\YL Bank account and FDs 6.5 lakh

`

Monthly income Monthly expenses Home loan EMI Surplus EPF7.3 lakh

1 lakh 50,000 22,000 28,000 Equity funds 3.2 lakh

EDUCATION COSTS WHAT TO DO

VARY DRAMATICALLY Start early and Re-visit the goal periodically:

z Ashish would likely need the money in 12–15 years. invest as much as Initially, he may not have any

While starting to invest for this goal is appropriate, it possible: With clear idea about Myra’s career

is difficult to determine the amount required. the goal being so choice. However, slowly, he will

z Education costs vary dramatically, depending on a obvious, it is start having a better vision of it.

number of factors: the education stream, whether or important for Then, he can revisit this goal and

not the child wants to study abroad, type of Ashish to start make the required correction.

institution, etc. investing for it as >O` `V\ ZOV\SK Z[HY[

early and as

z Also, given the growing popularity of new-age much as PU]LZ[PUN LHYS`

career options, it is quite likely that many new possible. By doing The later you start, the less corpus you will be

options will emerge in the next 10 years with totally so, he would get able to accumulate. Hence, start investing early.

different cost structures. enough time to How much would you accumulate

in a time frame of 15 years?

0UKPJH[P]L YHUNL VM H]LYHNL accumulate a Starts 77.78 In ` lakh

OPNOLY LK\JH[PVU JVZ[Z PU 0UKPH significant After

Now

Costs vary depending on a number of corpus while 1 yr 65.38

factors such as the type of institution – reaping the After 54.67

government, private or a premier college benefit of 2 yrs

After

Stream z Cost as of today (`) 3 yrs 45.45

z Cost after 15 yrs* (`) compounding. After 37.53

Medical 5 to 20 lakh There is no harm 4 yrs

After

education 12 to 48 lakh if he ends up 5 yrs 30.73

Commerce and 1 to 5 lakh accumulating a After 24.91

6 yrs

arts education 2.4 to 12 lakh larger corpus After 19.94 Assuming a

Management 5 to 15 lakh than the actual 7 yrs monthly SIP of

After

12 to 36 lakh requirement, but 8 yrs 15.72 `10,000, return of

12 per cent pa, and

Engineering 5 to 15 lakh he definitely After 12.14 SIP contributions

9 yrs

increasing by 10

education 12 to 36 lakh doesn’t want to After 9.11 per cent yearly

*Considering inflation at 6 per cent pa fall short of it. 10 yrs

42 Mutual Fund Insight March 2021

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.