Page 41 - mutual-fund-insight - Mar 2021_Neat

P. 41

FUND DSP TAX SAVER FUND REGULAR DIRECT

ANALYST’S

CH ICE A flexible approach

Launch he fund has done a pretty strong and provide long-term

January 2007 good job of beating an average compounding opportunities. But that

Fund manager Tpeer over the years. Its 10-year doesn’t mean that it goes overboard

Rohit Singhania

Charanjit Singh returns place it among the top five on expensive stocks. Unlike many of

funds in the category. It hit a bit of a its peers, the P/E ratio of its portfolio

rough patch in 2017 and 2018 when has hardly crossed 25 in the last five

Expense ratio (%) it found a place in the third quartile years.

DIRECT of the category. But it staged a great The fund maintains a well-

0.87 1.15

MIN FUND MEDIAN MAX comeback in 2019 to be ranked diversified portfolio of over 60 stocks

among the top three. and the allocation to large caps has

0.25 2.04 The fund doesn’t have a strong usually remained in a narrow range

REGULAR bias for either the growth or value of around 70 per cent in the last five

1.85 2.28

MIN FUND MEDIAN MAX styles of investing. Stocks are picked years. So, the portfolio is managed in

for the sustainability of their earnings a fairly conservative manner.

1.62 2.58

growth and return on equity. The Despite that, its track record

Trailing returns (%) fund is also open to taking positions suggests that the fund tends to fall

Regular Direct S&P BSE 500 TRI in stocks which present mispricing slightly more than the category

opportunities due to corporate average during bear phases but also

14.20 actions or relative to the company’s rises more than the category during a

1-Year 15.28 cash-generation ability. bull phase. But in any five-year

16.46

The valuations may take a back period in its life, it has remained

6.98 seat at times if business drivers are ahead of an average peer.

3-Year 8.02

6.76

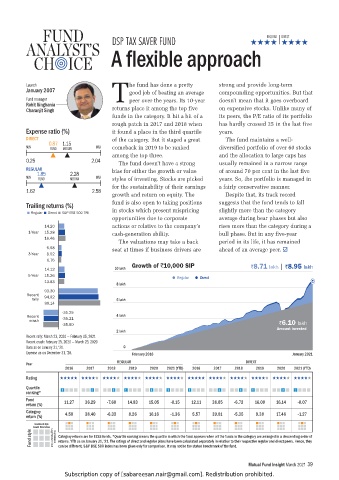

Growth of `10,000 SIP `8.71 lakh | `8.95 lakh

14.12 10 lakh

5-Year 15.26 Regular Direct

13.83

8 lakh

93.30

Recent 94.92

rally 6 lakh

99.14

-35.25

Recent -35.21 4 lakh

crash `6.10 lakh

-35.60

2 lakh Amount invested

Recent rally: March 23, 2020 — February 05, 2021

Recent crash: February 25, 2020 — March 23, 2020

Data as on January 31, ‘21. 0

Expense as on December 31, ‘20. February 2016 January 2021

REGULAR DIRECT

Year

2016 2017 2018 2019 2020 2021 (YTD) 2016 2017 2018 2019 2020 2021 (YTD)

Rating

Quartile 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4

ranking*

Fund 11.27 36.29 -7.60 14.83 15.05 -0.15 12.11 38.05 -6.72 16.00 16.14 -0.07

return (%)

Category 4.58 38.40 -6.33 8.26 16.16 -1.36 5.57 39.81 -5.35 9.38 17.46 -1.27

return (%)

Investment style

Fund style Growth Blend Value Large Medium Small Capitalisation Category returns are for ELSS funds. *Quartile ranking means the quartile in which the fund appears when all the funds in the category are arranged in a descending order of

returns. YTD as on January 31, ’21. The ratings of direct and regular plans have been calculated separately in relation to their respective regular and direct peers. Hence, they

can be different. S&P BSE 500 index has been given only for comparison. It may not be the stated benchmark of the fund.

Mutual Fund Insight March 2021 39

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.