Page 42 - mutual-fund-insight - Mar 2021_Neat

P. 42

FUND INVESCO INDIA TAX PLAN REGULAR DIRECT

ANALYST’S

CH ICE When safety is the priority

Launch he fund deserves a closer look constructing the portfolio. The fund

December 2006 for its consistency to beat an swings between market-cap segments

Fund manager Taverage peer, more so when the based on relative valuations.

Dhimant Kothari

Amit Nigam markets are going through a rough However, frequent fund manager

patch. In the last 13 calendar years, it changes are a bit of concern. Vetri

has underperformed an average peer Subramaniam (from December 2008

Expense ratio (%) only three times but never in a year till January 2017) and Vinay Paharia

DIRECT when the markets have crashed. In (June 2010–Mar 2018) had been its

0.90 1.15

MIN FUND MEDIAN MAX fact, in every such year (2008, 2011 long-time fund managers. After

and 2018), it was in the top quartile of Subramaniam’s exit, Taher Badshah

0.25 2.04 the category. The fund continued to co-managed it with Paharia for a brief

REGULAR display the same trait during the period. From March 2018, Amit

2.15 2.28

MIN FUND MEDIAN MAX quarter ending March 2020, when the Ganatra (who left in May 2020) was in

markets crashed due to COVID-19. charge, along with Dhimant Kothari.

1.62 2.58

This achievement should particularly Now after Ganatra’s exit as well, the

Trailing returns (%) appeal to investors who get anxious responsibility of building upon this

Regular Direct S&P BSE 500 TRI when markets fall. fund’s illustrious track record lies

The fund is managed with a with Kothari and Amit Nigam. A lot of

15.59 ‘growth at a reasonable price’ strategy. fund-manager changes are undesirable

1-Year 16.96 Stock selection is primarily bottom-up and though these haven’t impacted

16.46

but with an overlay of top-down the fund’s performance, it’s something

7.51 views and valuations while we would like to watch closely.

3-Year 8.95

6.76

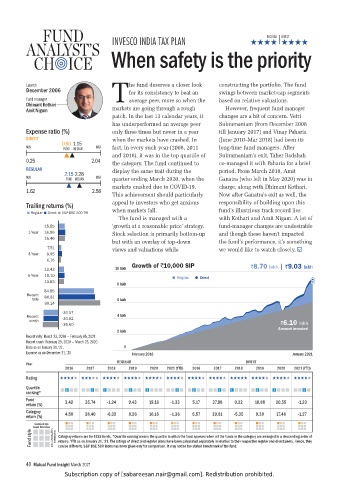

Growth of `10,000 SIP `8.70 lakh | `9.03 lakh

13.43 10 lakh

5-Year 15.10 Regular Direct

13.83

8 lakh

84.85

Recent 86.81

rally 6 lakh

99.14

-34.57

Recent -34.51 4 lakh

crash `6.10 lakh

-35.60

2 lakh Amount invested

Recent rally: March 23, 2020 — February 05, 2021

Recent crash: February 25, 2020 — March 23, 2020

Data as on January 31, ‘21. 0

Expense as on December 31, ‘20. February 2016 January 2021

REGULAR DIRECT

Year

2016 2017 2018 2019 2020 2021 (YTD) 2016 2017 2018 2019 2020 2021 (YTD)

Rating

Quartile 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4

ranking*

Fund 3.42 35.74 -1.24 9.43 19.16 -1.33 5.17 37.98 0.32 10.88 20.55 -1.23

return (%)

Category 4.58 38.40 -6.33 8.26 16.16 -1.36 5.57 39.81 -5.35 9.38 17.46 -1.27

return (%)

Investment style

Fund style Growth Blend Value Large Medium Small Capitalisation Category returns are for ELSS funds. *Quartile ranking means the quartile in which the fund appears when all the funds in the category are arranged in a descending order of

returns. YTD as on January 31, ’21. The ratings of direct and regular plans have been calculated separately in relation to their respective regular and direct peers. Hence, they

can be different. S&P BSE 500 index has been given only for comparison. It may not be the stated benchmark of the fund.

40 Mutual Fund Insight March 2021

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.