Page 43 - mutual-fund-insight - Mar 2021_Neat

P. 43

FUND MIRAE ASSET TAX SAVER FUND REGULAR DIRECT

ANALYST’S

CH ICE A champ in making

Launch he fund has remained in the state of the markets. The portfolio is

December 2015 top quartile in four of the five usually well spread out across 55-60

Fund manager Tcalendar years it has stocks. But the fund avoids companies

Neelesh Surana

completed thus far. In one year, it which lack a threshold scale, say of

missed the top quartile by a whisker. about `100 crore in operating profits.

The fund follows a ‘growth at a It also avoids taking cash calls and

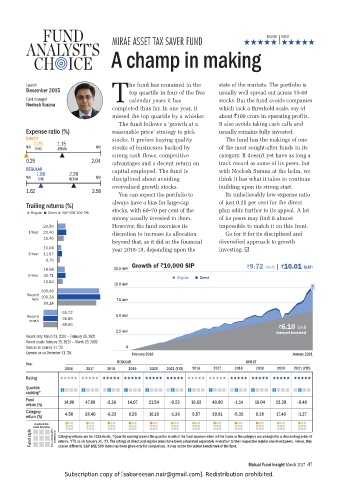

Expense ratio (%) reasonable price’ strategy to pick usually remains fully invested.

DIRECT stocks. It prefers buying quality The fund has the makings of one

0.25 1.15

MIN FUND MEDIAN MAX stocks of businesses backed by of the most sought-after funds in its

strong cash flows, competitive category. It doesn’t yet have as long a

0.25 2.04 advantages and a decent return on track record as some of its peers, but

REGULAR capital employed. The fund is with Neelesh Surana at the helm, we

1.86 2.28

MIN FUND MEDIAN MAX disciplined about avoiding think it has what it takes to continue

overvalued growth stocks. building upon its strong start.

1.62 2.58

You can expect the portfolio to Its unbelievably low expense ratio

Trailing returns (%) always have a bias for large-cap of just 0.25 per cent for the direct

Regular Direct S&P BSE 500 TRI stocks, with 60–70 per cent of the plan adds further to its appeal. A lot

money usually invested in them. of its peers may find it almost

20.56 However, the fund exercises its impossible to match it on this front.

1-Year 22.40 discretion to increase its allocation Go for it for its disciplined and

16.46

beyond that, as it did in the financial diversified approach to growth

10.04 year 2018-19, depending upon the investing.

3-Year 11.67

6.76

Growth of `10,000 SIP `9.72 lakh | `10.01 lakh

18.98 12.5 lakh

5-Year 20.71 Regular Direct

13.83

10.0 lakh

106.48

Recent 109.28

rally 7.5 lakh

99.14

-35.72

Recent -35.66 5.0 lakh

crash

-35.60 `6.10 lakh

2.5 lakh Amount invested

Recent rally: March 23, 2020 — February 05, 2021

Recent crash: February 25, 2020 — March 23, 2020

Data as on January 31, ‘21. 0

Expense as on December 31, ‘20. February 2016 January 2021

REGULAR DIRECT

Year

2016 2017 2018 2019 2020 2021 (YTD) 2016 2017 2018 2019 2020 2021 (YTD)

Rating

Quartile 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4

ranking*

Fund 14.80 47.88 -2.26 14.07 21.54 -0.53 16.63 49.80 -1.14 16.04 23.39 -0.40

return (%)

Category 4.58 38.40 -6.33 8.26 16.16 -1.36 5.57 39.81 -5.35 9.38 17.46 -1.27

return (%)

Investment style

Fund style Growth Blend Value Large Medium Small Capitalisation Category returns are for ELSS funds. *Quartile ranking means the quartile in which the fund appears when all the funds in the category are arranged in a descending order of

returns. YTD as on January 31, ’21. The ratings of direct and regular plans have been calculated separately in relation to their respective regular and direct peers. Hence, they

can be different. S&P BSE 500 index has been given only for comparison. It may not be the stated benchmark of the fund.

Mutual Fund Insight March 2021 41

Subscription copy of [sabareesan.nair@gmail.com]. Redistribution prohibited.