Page 1083 - How to Make Money in Stocks Trilogy

P. 1083

Buying Checklist 69

We’ll get into charts and what they reveal about the trading of institu-

tional investors in Chapter 6, “Don’t Invest Blindly.” (Feel free to jump

ahead to that if you’re curious.)

For now, let’s focus on some other quick ways you can see what the all-

important fund managers and other institutions are up to.

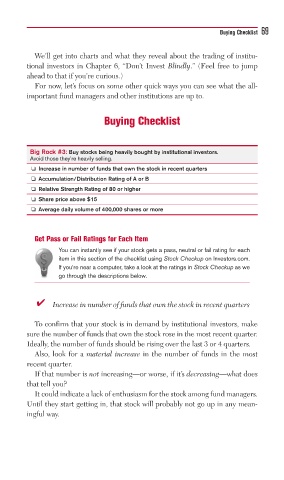

Buying Checklist

Big Rock #3: Buy stocks being heavily bought by institutional investors.

Avoid those they’re heavily selling.

❏ Increase in number of funds that own the stock in recent quarters

❏ Accumulation/Distribution Rating of A or B

❏ Relative Strength Rating of 80 or higher

❏ Share price above $15

❏ Average daily volume of 400,000 shares or more

Get Pass or Fail Ratings for Each Item

You can instantly see if your stock gets a pass, neutral or fail rating for each

item in this section of the checklist using Stock Checkup on Investors.com.

If you’re near a computer, take a look at the ratings in Stock Checkup as we

go through the descriptions below.

■ ✔ Increase in number of funds that own the stock in recent quarters

To confirm that your stock is in demand by institutional investors, make

sure the number of funds that own the stock rose in the most recent quarter.

Ideally, the number of funds should be rising over the last 3 or 4 quarters.

Also, look for a material increase in the number of funds in the most

recent quarter.

If that number is not increasing—or worse, if it’s decreasing—what does

that tell you?

It could indicate a lack of enthusiasm for the stock among fund managers.

Until they start getting in, that stock will probably not go up in any mean-

ingful way.