Page 1181 - How to Make Money in Stocks Trilogy

P. 1181

164 HOW TO MAKE MONEY IN STOCKS—GETTING STARTED

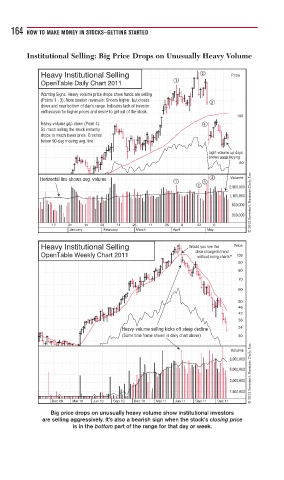

Institutional Selling: Big Price Drops on Unusually Heavy Volume

Heavy Institutional Selling 2 Price

1

OpenTable Daily Chart 2011

Warning Signs: Heavy-volume price drops show funds are selling

(Points 1 - 3). Note bearish reversals: Shoots higher, but closes 3

down and near bottom of day’s range. Indicates lack of investor

enthusiasm for higher prices and desire to get out of the stock.

100

Heavy-volume gap down (Point 4): 4

So much selling the stock instantly

drops to much lower price. Crashes

below 50-day moving avg. line.

Light-volume up days

shows weak buying

80

© 2013 Investor’s Business Daily, Inc.

Horizontal line shows avg. volume 4 Volume

1 3

2 2,000,000

1,100,000

600,000

300,000

17 31 14 28 11 25 11 25 8 22 6

January February March April May

Heavy Institutional Selling Would you see this Price

clear change in trend

OpenTable Weekly Chart 2011 without using charts? 100

90

80

70

60

50

46

42

38

Heavy-volume selling kicks off steep decline 34

(Same time frame shown in daily chart above) 30

© 2013 Investor’s Business Daily, Inc.

Volume

8,000,000

5,000,000

3,000,000

1,800,000

Dec 09 Mar 10 Jun 10 Sep 10 Dec 10 Mar 11 Jun 11 Sep 11 Dec 11

Big price drops on unusually heavy volume show institutional investors

are selling aggressively. It’s also a bearish sign when the stock’s closing price

is in the bottom part of the range for that day or week.