Page 1180 - How to Make Money in Stocks Trilogy

P. 1180

Don’t Invest Blindly: Use Charts to See the Best Time to Buy and Sell 163

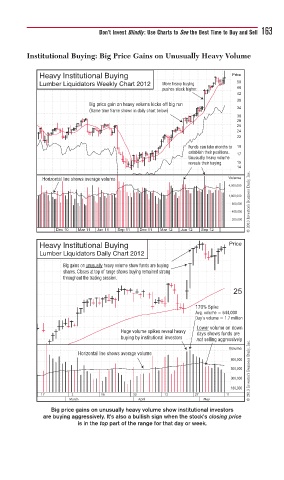

Institutional Buying: Big Price Gains on Unusually Heavy Volume

Heavy Institutional Buying Price

Lumber Liquidators Weekly Chart 2012 More heavy buying 50

pushes stock higher. 46

42

38

Big price gain on heavy volume kicks off big run

34

(Same time frame shown in daily chart below)

30

28

26

24

22

Funds can take months to 19

establish their positions. 17

Unusually heavy volume

reveals their buying. 15

14

© 2013 Investor’s Business Daily, Inc.

Horizontal line shows average volume Volume

4,000,000

1,600,000

800,000

400,000

200,000

Dec 10 Mar 11 Jun 11 Sep 11 Dec 11 Mar 12 Jun 12 Sep 12

Heavy Institutional Buying Price

Lumber Liquidators Daily Chart 2012

Big gains on unusually heavy volume show funds are buying

shares. Closes at top of range shows buying remained strong

throughout the trading session.

25

170% Spike

Avg. volume = 644,000

Day’s volume = 1.7 million

Lower volume on down

Huge volume spikes reveal heavy days shows funds are

buying by institutional investors

not selling aggressively

Volume

Horizontal line shows average volume

800,000

500,000 © 2013 Investor’s Business Daily, Inc.

300,000

180,000

17 2 16 30 13 27 11

March April May

Big price gains on unusually heavy volume show institutional investors

are buying aggressively. It’s also a bullish sign when the stock’s closing price

is in the top part of the range for that day or week.